The strength and the prosperity of the global halal industry has been trumpeted all over the news. The rise of Generation M – formally known as the stylish Muslim generation – is an eye-opener for most businesses. Though significant research has not exhausted the opportunities in this industry, this article tries to shed some light to explore the the growth and potentiality of the global halal industry.

Last month on The Economic Times of India, Patanjali announced the launch of ‘Swadeshi’ jeans – supposedly a religious jeans to the devotees of Hinduism. Patanjali Ayurved is an Indian FMCG company under the leadership of the most influential religious/yoga teacher in India, Swami Baba Ramdev. Patanjali is specialized in mineral and herbal products that is in direct competition with the world’s leading conglomerates such as Unilever, Nestle and P&G. The group reach its revenue cap of $750 million in 2015 and has stretched its business operations to Bangladesh, Nepal, Azerbaijan and the Middle East. This is a company that follows the doctrine of Hinduism contrary to the mainstream businesses, and the growth and prosperity has certainly challenged the leading businesses in India.

Blending business with religion is often an issue among religious groups. It creates a sensitive distortion even if it meant for constructive criticisms. This being the general ideology, Patanjali took-off and placed itself in the Indian market as a unique business concept focusing merely on the aspect of ‘spirituality’ with a touch of Baba Ramdev’s prolonged mantra.

One might wonder progress and the success of Patanjali and why so much potential in this religious segment. Like any business organisation, the key decision solely depends on the size of the market, potential growth and profitability. Hinduism consists of over 1 billion adherents or 15% of the world’s population, and 95% resides in India. Baba Ramdev leads the ranks of India’s most religious figures. He is ranked before Mata Amritanandamayi, founder of the famous Amrita Institute of Medical Sciences Hospital in Kochin and Sri Sri Ravishankar, another renowned Guru in India. This makes him the perfect tool from a marketing perspective. Thus, the application of right blend will lure the potential congregation.

On the other realm, Muslim population consist of 1.6 billion or 23% of the world’s population. Statistics available from Pew Research Center further indicated that 60% of this Muslim population reside in Asia while 20% are in the MENA region. A crucial market considering the size. Researchers, including the likes of Joan Henderson, Associate Professor at Nanyang Technological University (Singapore) and Ala Al-Hamarneh, Assistant Professor at University of Mainz (Germany), concluded the prospect and affluence of this market. They noted that the behaviors of Muslim market, though not in contrary to other population while also adhering to certain religious etiquette, are high in consumption and wealthy. The market resorts to luxury spending and consuming goods that are in line with sharia law.

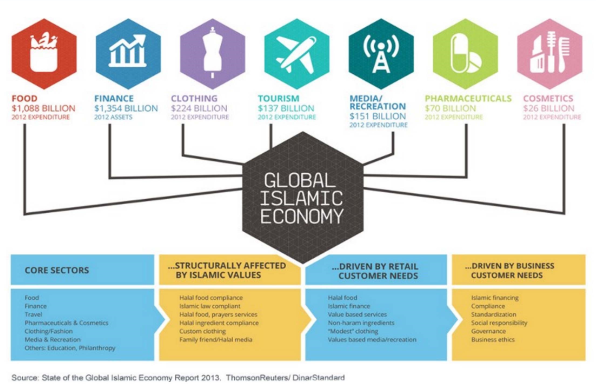

‘State of the Global Islamic Economy’ is a brief report published by Thomson Reuters in association with DinaStandards exploring the global halal economy. The report stated that the global halal economy is worth over $3.66 trillion; $2 trillion on food & lifestyle sector expenditure and $1.66 trillion in Islamic finance assets. This is a robust economy largely in absence of global brands and products. The report then provides the significance of each industry, current products and opportunities available and case studies to back the claims.

Reiterating to Patanjali, it is positioned to a specific group with clear directions. It is groomed to fetch a specific demography similar to a halal economy. Halal is a unique concept and the epitome of Islam. It targets the entire Muslim community. But the problem is the lack of businesses targeting this segment. Reports, events and conferences reverberated the opportunities in this sector, including halal food to Islamic finance, halal travel to Islamic fashion and media & recreation to pharma & cosmetics. Professor Din Kadir from the Universiti Utara Malaysia indicated that some businesses have started to diverge and strategically align operations parallel to halal spectrum, while others Islamicized conventional operations to Islamic operations. These include Islamic financing, Takaful (Islamic insurance) and Sukuk (Islamic bonds) in Malaysia. He also noted that in doing so businesses have captured a significant market not primarily from Malaysia but also from other countries.

Halal Food

Halal food sector is the biggest market in the Muslim economy spending over $2 trillion (or 17.7% of the global F&B market) on food and life style. This is further expected to grow $2.5 trillion in 2019. Moreover, from a list of 70 countries specified in the global halal economy, Malaysia, Dubai and Australia are the champions of halal food suppliers. In terms of halal consumption, Indonesia is ranked at the top with $190.4 billion. Halal food logistics acts as a subsidiary to the halal food, though the chemistry of handling halal food is contrary to that of the mass. The halal logistics is another prospective market for businesses which is valued at $151 billion in 2013.

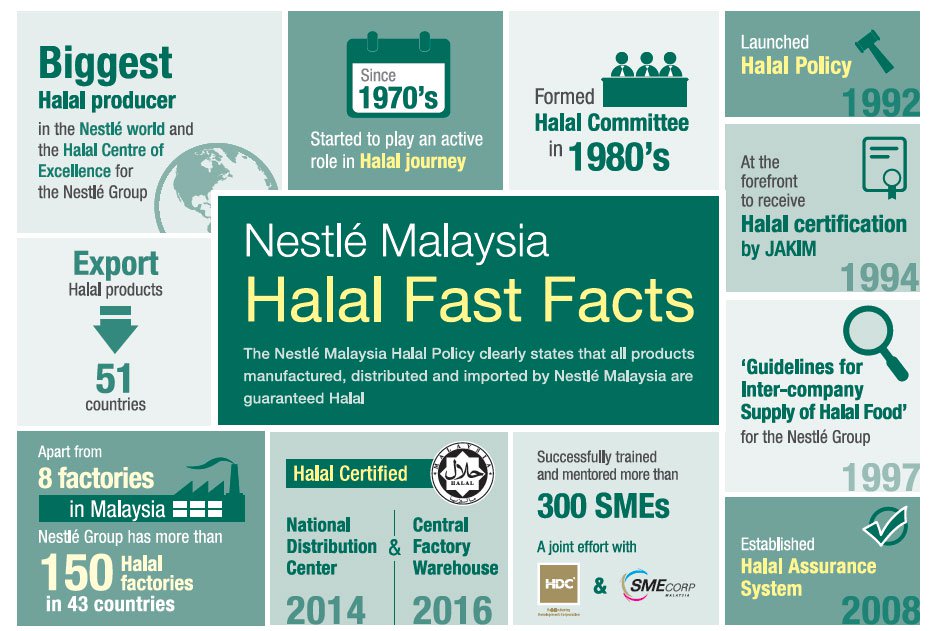

Organisation of Islamic Cooperation (OIC) represents 57 member countries in four continents, portraying one of the biggest regions targeted by halal food suppliers. Nestle, for example, made $3 billion sales from food products simply adhering to the halal indications. Likewise, there are companies that made remarkable growth through the application of halal certification/logo.

Halal/Islamic Finance

Islamic Finance sector is the second largest industry in the halal economy and it is estimated at $1.66 trillion in 2013. Glancing through this sector indicated that Islamic funds and Sukuks demonstrated growth at 14% and 11% respectively, whereas banking experienced 5% drop in assets. Malaysia, Bahrain, and United Arab Emirates lead in the race of halal financial sector. The sector also achieved further achievement with expansion of Sukuk (halal/Islamic bonds) to UK, South Africa, Luxembourg, and Hong Kong. SEDCO and Arabesques, for example, are social impact investing funds driving the industry’s connectivity with this wider global ethical pool of capital.

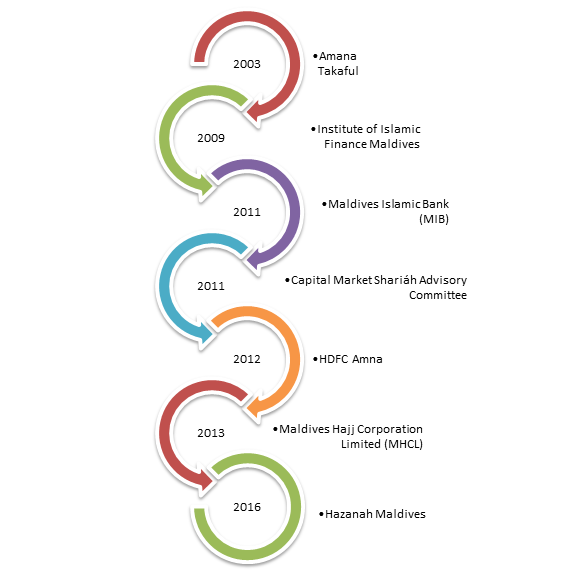

Though little has surfaced in the halal economy of Maldives, majority is dominated in the Islamic finance sector. This includes Maldives Islamic Bank (MIB), the first sharia compliant bank and Amana Takaful, the first Islamic insurance company. Likewise, companies initially engaging in conventional approaches were Islamicized. Allied Insurance group, for example, established their Islamic insurance arm by the name Ayady Takaful, while Bank of Maldives (BML) recently inaugurated their Islamic banking operations. Housing Development Finance Corporation (HDFC) is a full-fledged housing finance company, they opened their Islamic window ‘Amna’ to attract sharia compliant housing projects. The most recent development in this sector would be Hazana Maldives – a government finance company specializing in Islamic investment funds.

Halal/Muslim-Friendly Tourism

The halal travel segment is an ever growing sector of the tourism industry. Halal travelers – Muslim traveler, expect their vacations to be in accordance with Islamic religious principles and help preserve their Islamic ethos while travelling, even when not in a country whose prominent religion is Islam. The majority of the Muslim population found in Asia and countries where Islam is a prominent religion. However, a sizable population can be extracted from non-Muslim majority countries. For instance, one-fifth of the Muslim population reside in India while China has more Muslims than Syria. In addition to this, Russia is home to more Muslims than Jordan and Libya combined, according to the statistics published by Pew Research Center. Regardless of the size, the global context of tourism has not been able to accommodate this market and fulfill its needs. This brings us to the third and the most prominent sector for Maldives; the halal travel sector.

To bring into perspective the size and value of the halal tourism sector, the Muslim travel market is larger than the US outbound tourist market which is worth $131 billion. It is also larger than China market valued at $122 billion and Germany $99 billion. Among the top source regions, Gulf Cooperation Counsel (GCC) is responsible for a significant expenditure on travel. This include Saudi Arabia ($17.8 billion), United Arab Emirates ($11.2 billion), Qatar ($ 7.8 billion) and Kuwait ($7.7 billion). Outside the this region, the biggest Muslim population country is Indonesia representing 200 million Muslims. Indonesia spent about $7.5 billion on travel while Iran contributed $14.3 billion. Countries with minor Muslim population includes Russia ($5.4 billion), Germany ($3.6 billion), United Kingdom ($2.4 billion) and France ($2.3 billion) respectively.

Therefore, with the growing number of Muslim travelers, which was 117 million recorded in 2015, has given a momentum to destination promoters like Maldives and travel operators, agents, hotels and the airline industry. The global Muslim travel market spent over $142 billion in 2014 or 11% of the global tourism expenditure (excluding Hajj and Umra). This is expected to grow $233 billion in 2020.

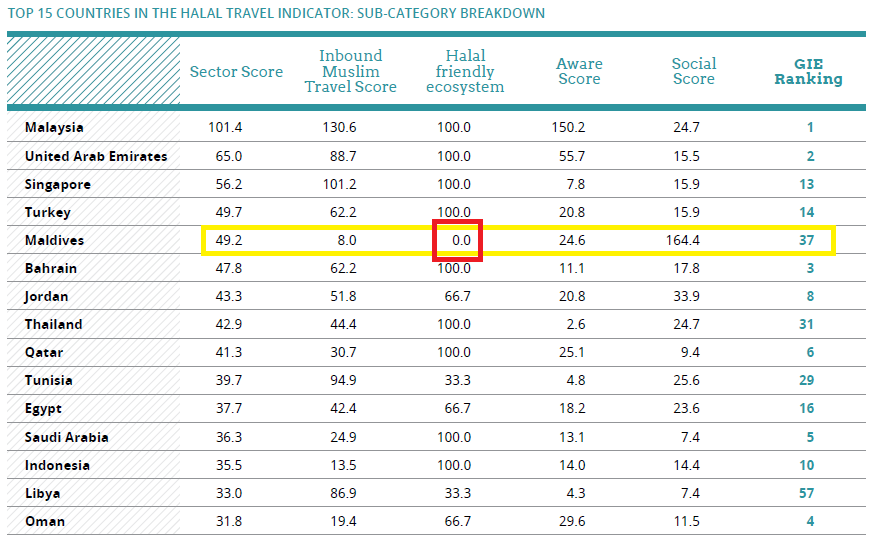

CrescentRrating is a leading authority on Halal-friendly travel. Based in the Singapore, the company focuses on halal travel consultancy and marketing. The company’s halal rating systems is a popular tool that rates hotel properties based on a halal-friendly scale from 1-7. This enables Muslim travelers with ease of selecting hotels that provides basic facilities pertinent to sharia law. For instance, the ranking indicates availability of prayer rooms, prayer direction, halal food, halal cosmetics, services in the month of Ramadan and the likes. The company also moved into developing the first Global Muslim Travel Index in association with Master Card. The index provides a benchmark for researcher, developers and destination marketers.

Restrictions on controversial Muslim swim wear, the Burkini, has averted news all over the world, but Muslim travelers are still in the limelight regardless. To counter the negativity, a number initiations in the form of conferences, workshops and exhibitions are a compilation to this edition. For example, Halal Expo Japan and Halal Exhibition in Indonesia are a few popular events in the Asia region while the first halal conferences in Spain and second in Turkey are noteworthy events that bolstered the movement of Muslim travelers.

It is important to note some of the promotional and marketing works conducted by different countries. Japan has been a major player that targets Muslim tourists. Integration of prayer-rooms to halal cafes/restaurants can be found in various parts of the country. Likewise, Australia, New Zealand, Thailand, UK and Spain have developed attractive halal travel packages. The Andalusian Route, for example, is a Spanish travel agency that provides historical and cultural tours packages. The company provides heritage tours which covers the rich Islamic civilization in Spain known as the Andalusia (pictures below).

Malaysia is, without a doubt, the undisputed champion to target Muslim travelers. They have been listed as the top favorite destination for Muslim travelers by Crescentrating for 5 consecutive years. Halal facilities and services can be found in almost all the parts of Malaysia including halal food, prayer rooms and amenities compliant to sharia. This is also a country that practices Christianity and Buddhism. Churches, Temples, religious festive takes place throughout the year. The impact of multi-religion context have little to impact in this country.

There are contributions by businesses in this sector to assist Muslim travelers when traveling abroad. Halal Trip, contrary to the famous TripAdvisor, is a website/app that gives important information related to halal hotels and cafes. The app also make hotel reservations. Likewise, Halalbooking is a UK based website that replicates something similar to Booking.com or Expedia. It provides exclusive packages for Muslim travelers.

Again, reiterating to the context of Maldives to see potential of Halal travel sector is important. Maldives is a 100% Muslim country and a favorite destination for Muslim/Arab travelers. The secluded island life and privacy is a luxury for Muslim travelers. One one side, they travel with large groups, large family members and look for apartments and bungalows where their family can enjoy privately. The other group looks forward to a relaxing honeymoon and some quite time. Maldives provides the best of both. From resorts to hotels or even guesthouses, the presence of mosques and halal food can be found. This is one of the best locations for rich Arab travelers looking for family trips or dream honeymoon vacations. The only problem is the ‘Sun, Sea, and Sand’ is not heavily promoted in the Middle East and the industry received a shy of 40,000 tourists in 2015.

Caprice Gold Maldives, for example, was the first ever 100% sharia compliant resort island planned to open in 2014. The island equipped with some 670 rooms, segregated pools, buffets and private beaches. The development, however, failed to launch due to a conflict with Caprice Gold Turkey and ADK company in Maldives. The $170 million investment came to a halt in late 2014 stagnating the opportunities in this sector.

Maldives tourism industry is over-depending on the Chinese market which also represents 30% of the market share. The Muslim segment can be a good additional market to Maldives with the amenities and services ready at hand. There are one-third of the Muslims residing in India while Maldives is closely connected to GCC, MENA and a member country in the OIC. Developing connections and promoting Maldives as a halal destination would not be a challenge. This could also trigger another opportunity in terms of tourist arrivals and investments. Coming to a consensus and applying the right marketing tool can really make a change and reach the 2020 tourism goals.

Other Sectors

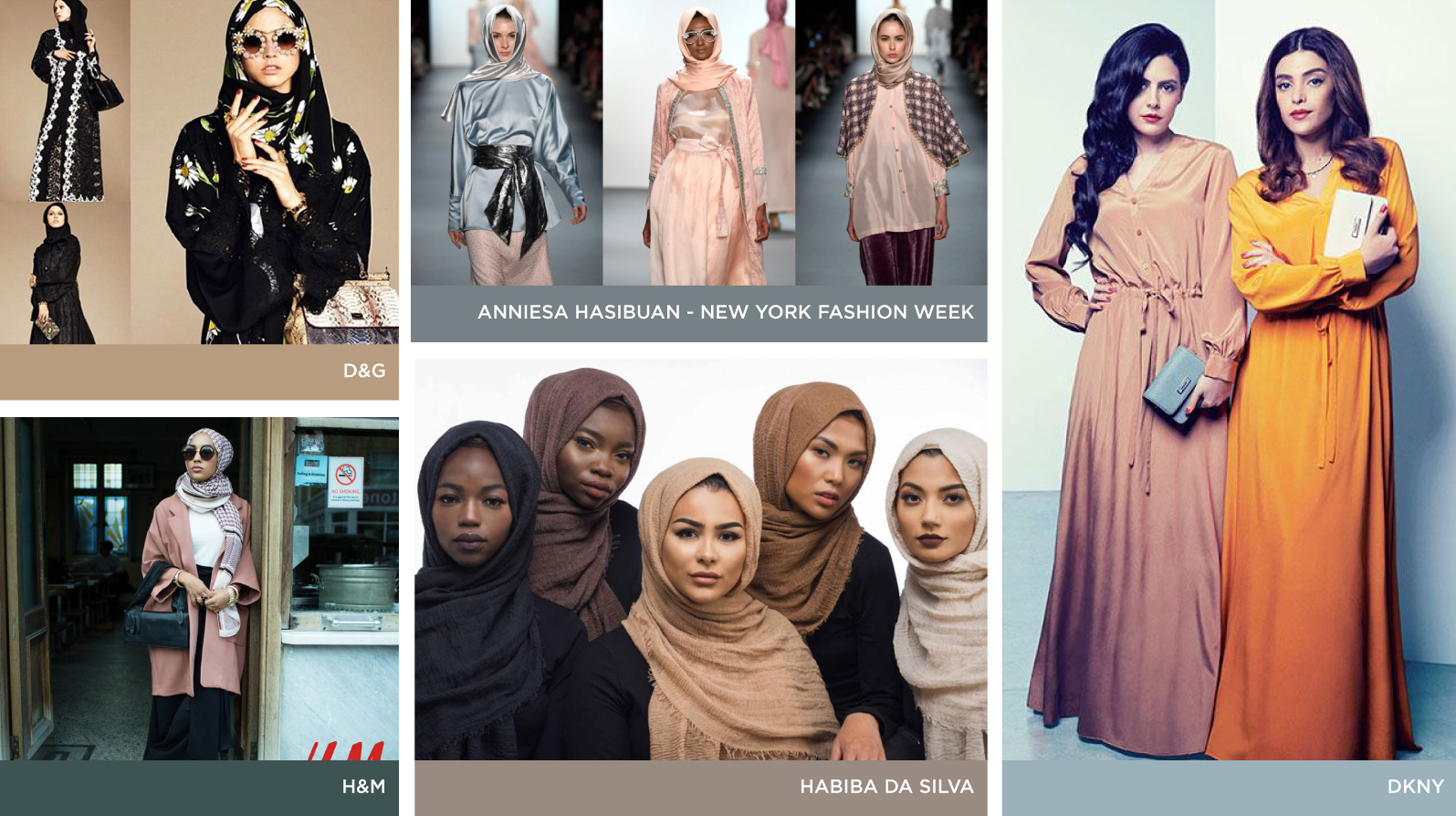

There are many areas where the halal market would be applicable. Many industries have been accepting and adapting to this untapped market. Industries such as Medicines and Pharmaceuticals, Technology and even Fashion. The Muslim way of dressing up is very different from the norm. Full body coverage with a head scarf or veil is common among all Muslim countries. To cater to this demography, many international brands such as H&M, DKNY and Dolce and Gabana have specialized custom Hijab collections for Muslim women. Last September history was made at the New York Fashion week when Indonesian designer Anniesa Hasibuan showed her designs in complete hijab from head to toe. It was very well received and proved that the demand was there and it is a market worth exploring.

The Halal market is an untapped goldmine. With changes in trends and tastes of consumers, suppliers and service providers must break away from the norms and adapt to the ever evolving demographic of the Generation M if they are to successfully penetrate into the international business arena.

Contributing Editor: Zakwaan