The Ministry of Economic Development and Trade and the People’s Bank of China (PBOC) have signed a Memorandum of Understanding (MoU) aimed at enhancing economic cooperation between the two nations. The agreement seeks to streamline trade and investment processes by establishing a framework for settling current account transactions and direct investments in local currencies.

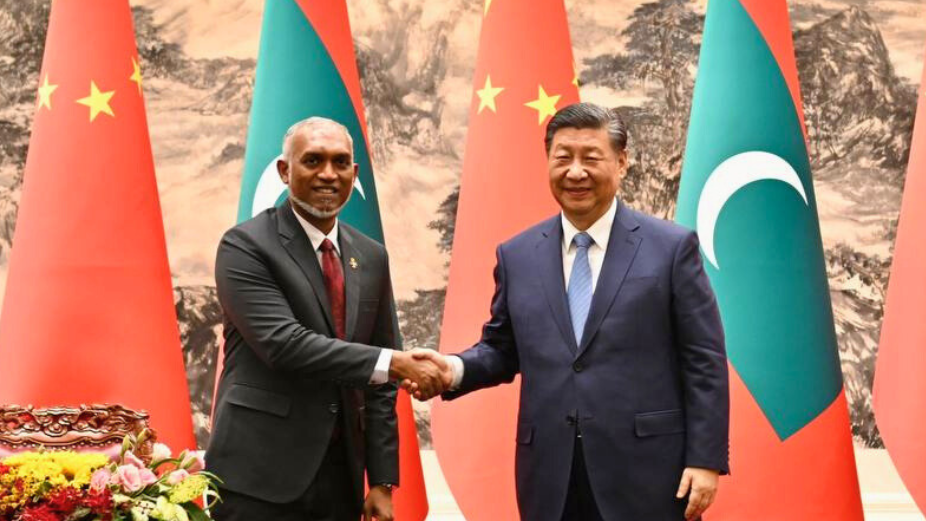

According to the ministry’s announcement yesterday, the MoU follows a state visit by Maldivian President Dr. Mohamed Muizzu to China in January 2024, where both leaders emphasised their commitment to deepening economic relations.

Under the new framework, transactions between the two countries will be conducted in local currencies, simplifying trade for Maldivian importers from China and boosting cross-border investments.

China is a major trading partner for the Maldives, with bilateral trade surpassing USD 700 million. Additionally, China remains the largest source of tourists to the Maldives, with over 200,000 Chinese visitors arriving this year alone.

A Crucial Lifeline

The signing of the MoU comes at a critical time for the Maldives, which is grappling with heightened concerns about a potential default on its Islamic sovereign debt. Moody’s has recently raised alarms about the rising risk of default, highlighting significant financial vulnerabilities. However, the MoU has led to a notable rebound in the Maldives’ sukuk bond, which increased by 4.2 cents to nearly 79 cents on the dollar, recovering from a record low of 68 cents earlier this month.

China’s foreign ministry has reiterated its support for the Maldives, with spokesperson Mao Ning telling Reuters that China will continue to assist the island nation’s economic and social development.

In light of declining usable dollar reserves, Minister of Economic Development and Trade Mohamed Saeed remarked that the agreement will help reduce reliance on the dollar and support the appreciation of the Maldivian rufiyaa. “This MoU is a strategic step towards stabilising our economy and easing trade processes,” Saeed added.

Despite the positive effects of the MoU, analysts caution that the Maldives remains in a precarious financial position. Moody’s has warned that the country’s reserves are inadequate to cover upcoming debt payments, with significant obligations due in 2026. Meanwhile, the Maldivian central bank has committed to making a $25 million debt payment next month, but the financial situation remains challenging.

The Maldives faces ongoing financial pressures with a substantial portion of its debt owed to China and India—$1.37 billion and $124 million, respectively—compounding its economic difficulties.