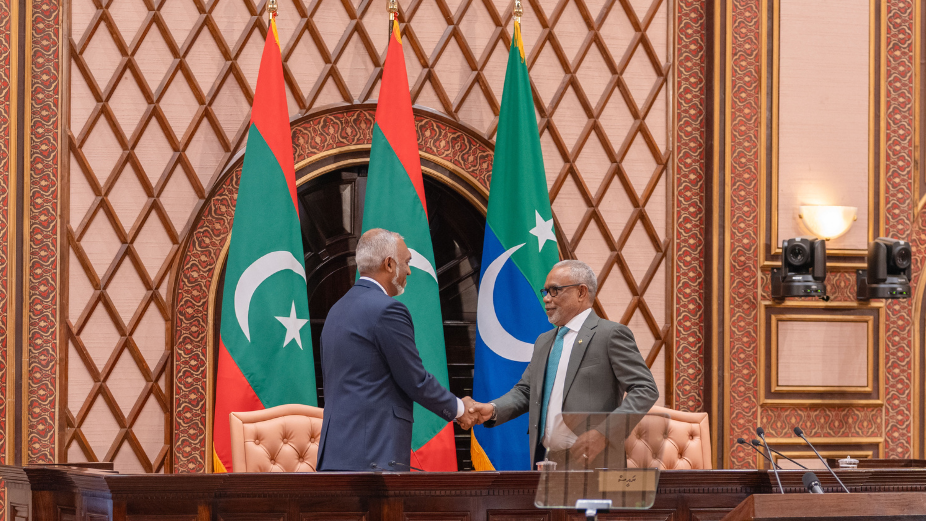

As the People’s Majlis reconvened for its fourth session today, the previous term’s legislative actions come under scrutiny. The third session of 2024 saw a wave of amendments and new laws aimed at shaping the Maldivian economy. However, the effectiveness of these measures and the nature of parliamentary debate raise critical questions about whether the legislative body is truly functioning as an independent democratic institution or merely rubber-stamping executive directives.

Major Economic Moves: Policies That Shaped the Economy

1. Taxation: Raising Revenue or Burdening Businesses? One of the most impactful changes was the amendment to the Goods and Services Tax (GST) Act, which increased Tourism Goods and Services Tax (TGST) to 17%. The Green Tax was also doubled, and airport taxes and departure fees were raised for all passengers except Maldivians in economy class. These measures increase government revenue but at the cost of raising operational expenses for businesses and making Maldives a pricier destination for tourists.

While additional tax revenue is crucial for public spending, the lack of extensive debate on potential consequences—such as declining competitiveness in tourism—suggests a one-sided legislative process. Given global economic uncertainties, was this the right time for a tax hike, or was it a politically convenient move with little regard for long-term sustainability?

Verdict: The tax hikes will generate revenue, but the lack of robust discourse on economic impact weakens their credibility.

2. Foreign Currency Framework: Real Reform or Superficial Fix? The amendment to the Foreign Currency Act introduced a legal structure for forex transactions by businesses operating under Maldivian law, mainly targeting the tourism sector. Theoretically, this should reduce unofficial forex trading and help stabilise exchange rates. However, there is little clarity on how effective this has been and whether it will meaningfully address forex shortages.

Given the lack of an independent financial authority pushing for this reform and the speed at which it was passed, it is unclear if this law is a genuine economic reform or simply a regulatory measure to centralise currency control under the government. Without clear implementation mechanisms, businesses may have to continue relying on unofficial currency exchanges.

Verdict: A necessary step, but its real impact depends on enforcement and transparency.

3. Import and Business Regulations: A Move Towards Protectionism? The parliament also passed amendments to the Import-Export Act, raising duties on cigarettes, vapes, and e-cigarette flavours. This, combined with changes to the Tobacco Control Act, which outright banned the import, sale, and distribution of vapes, disrupted businesses operating in this sector.

While the public health justification for banning vapes is considered popular amongst some, the complete lack of alternative nicotine replacement strategies or transition plans raised concerns. The abrupt implementation created an unregulated black market overnight, defeating the stated goal of controlling tobacco use.

Additionally, the Tourism Act amendment now mandates the government’s direct involvement in deciding which islands, lagoons, and lands can be leased each year. Any changes to this list require presidential approval. This level of control over tourism assets raises concerns about the lack of transparent decision-making and increased political influence over investments.

Verdict: The policies create more regulatory hurdles without offering clear economic benefits or transition strategies.

Effectiveness of Parliament: A Rubber Stamp for the Executive?

Beyond the specific economic measures, a bigger question looms over the role of the People’s Majlis itself. The third session saw nine bills passed, many of which were proposed by the executive, with little substantive debate or amendments from MPs. Most bills sailed through without significant opposition, indicating a lack of robust legislative oversight.

The rejection of a resolution calling on the government to ban Israeli passport holders showed that some decisions are still made with a degree of pragmatism, likely due to economic considerations. However, the quick ratification of constitutional amendments, particularly those expanding presidential powers and tightening control over state institutions, highlights a concerning trend towards centralised governance.

Key ministerial reshuffles and new appointments were approved with minimal resistance, and controversial bills, like the one proposing a Maldives Media and Broadcasting Commission, were only withdrawn due to public backlash rather than parliamentary debate.

When evaluating the third session, the overarching theme is the lack of strong opposition and critical discussion. Rather than acting as a check on executive power, the People’s Majlis appears to function as an extension of the administration, rubber-stamping policies with little challenge.

Final Verdict: Minimal Debate, Maximum Compliance

While some economic policies had merit, the manner in which they were passed—without thorough discourse or amendment or even proper input from stakeholders—raises concerns about legislative independence. The parliament largely followed the government’s directives, failing to rigorously assess the long-term economic consequences of its decisions. An effective parliament should provide oversight, challenge assumptions, and refine policies—not merely endorse executive mandates.

As the fourth session begins, the challenge for the Majlis is clear: will it continue to function as a legislative body that critically evaluates economic policy, or will it remain a rubber-stamp institution?