In a significant move to boost economic cooperation and foster cross-border investments, the Maldives and Malaysia have officially signed a Double Tax Avoidance Agreement (DTAA). The agreement, aimed at enhancing taxpayer certainty and preventing double taxation, is set to solidify the economic relations between the two nations.

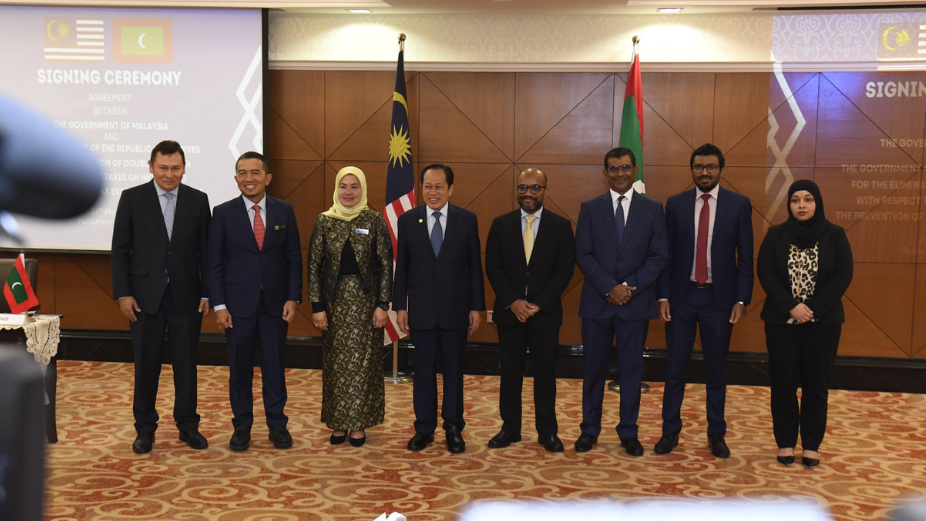

The agreement was signed during a ceremony held at the Parliament Building of Malaysia. This bilateral agreement marks a crucial milestone in the efforts to encourage investment and trade between Maldives and Malaysia.

The Double Tax Avoidance Agreement ensures that residents of both nations are protected from paying taxes on the same income in both jurisdictions. By eliminating the risk of double taxation, the agreement promotes investor confidence, removes barriers, and enhances the attractiveness of both countries for businesses and individuals seeking cross-border opportunities.

The Double Tax Avoidance Agreement is expected to have a positive impact on various sectors, including tourism, infrastructure, finance, and technology. It will pave the way for increased bilateral trade, joint ventures, and collaboration between businesses from both countries.

Moreover, the agreement will further strengthen the economic ties between Maldives and Malaysia. By fostering a conducive environment for trade and investments, it will contribute to the sustainable growth and development of both nations.

With the signing of this agreement, Maldives and Malaysia join a growing list of nations that have recognized the importance of double tax avoidance in promoting international trade and investments. The agreement reflects the willingness of both countries to create a business-friendly environment, reduce tax barriers, and attract foreign investors.

As the Maldives and Malaysia solidify their economic partnership through the Double Tax Avoidance Agreement, the stage is set for greater collaboration, increased trade, and enhanced prosperity for both nations.