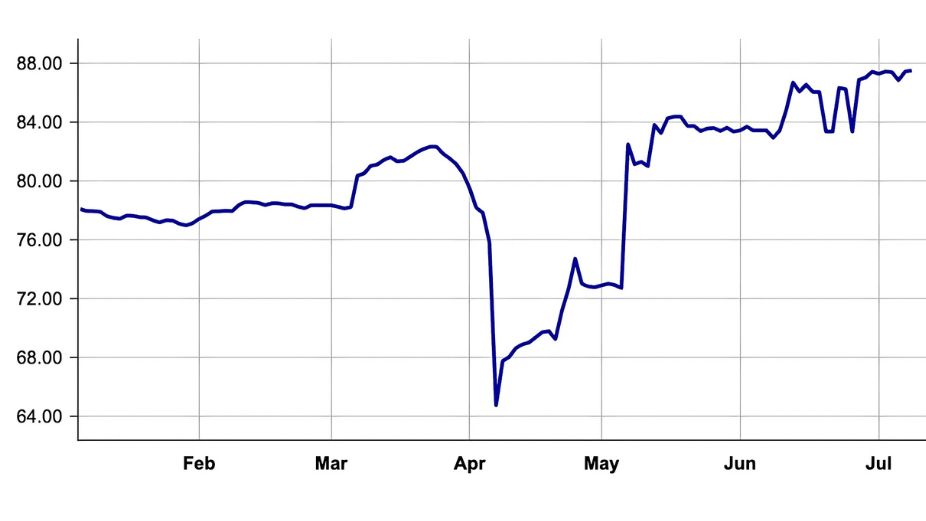

The price of the Maldives’ sovereign Sukuk has risen sharply, from approximately USD 64.7 in early April 2025 to USD 87.5 on 8 July, highlighting growing investor confidence that appears to outpace the country’s still-stressed credit standing.

What’s Behind the Rally?

According to the Ministry of Finance and Planning, recent fiscal discipline has bolstered sentiment. In March, the government settled a large private creditor repayment. This was followed by the timely payment of a Sukuk coupon in April. Simultaneously, discussions with bilateral partners have advanced negotiations around an upcoming refinancing package. These moves are credited with reassuring markets of the Maldives’ commitment to honouring its debts.

There is also evidence of favourable external factors. Gross foreign exchange reserves almost doubled from USD 371 million in September 2024 to USD 856 million in April, partly due to a USD 400 million currency swap with India’s central bank and strong tourism inflows.

But Credit Ratings Remain Weak

Despite these improvements, Moody’s and Fitch have retained low sovereign ratings. Moody’s has maintained its rating at Caa2 with a negative outlook since confirming it in December 2024. Fitch affirmed its CC rating in June 2025, warning of very high levels of credit risk and emphasising that default remains a distinct possibility.

These ratings reflect substantial external vulnerabilities, including heavy upcoming debt repayment obligations (USD 688 million due in the second half of 2025 and USD 1.1 billion in 2026), shallow net foreign reserves, and elevated debt-to-GDP ratios projected at around 125 percent for 2026.

So Why the Sukuk Surge?

A disconnect is emerging between market pricing and long-term rating assessments.

First, short-term liquidity gains from the RBI swap and tourist revenues have provided immediate reassurance to investors facing imminent repayments.

Second, tangible policy actions, including the March repayment and April coupon payment, have strengthened the Maldives’ reputation for fiscal responsibility.

Third, renewed refinancing momentum through ongoing negotiations with bilateral creditors signals that long-term financial planning might be stabilising.

In effect, investors appear to be treating the Sukuk more like a bet on policy follow-through and liquidity relief than on structural economic strength.

What It Means for the Future

The elevated Sukuk price demonstrates a market-implied recognition that policy interventions are yielding results. Yet the fundamental risks remain entrenched, including low net reserves, significant refinancing needs, and a bloated debt burden. Critics and rating agencies continue to warn that default remains probable unless fiscal reforms advance and buffer reserves rise.

For the Maldives, the challenge lies in converting this temporary market confidence into sustainable fiscal stability. Upcoming refinancing outcomes, reserve improvements, and meaningful reform measures will determine whether the Sukuk price surge represents a genuine turnaround or merely a short-term reprieve.