The Maldives Inland Revenue Authority (MIRA) has highlighted that Sunday, October 2023, marks the deadline for filing Goods and Services Tax (GST) returns for September 2023 and the third quarter of the year.

Entities registered for GST in the Maldives are required to file their returns by this date.

Among GST-registered entities, small businesses have a lower rate of timely return filings. Consistent delays may result in reduced opportunities for tax penalty waivers.

It’s essential for those filing GST returns to incorporate the amount collected as the plastic bag fee in their tax statement. This fee must be detailed and paid to MIRA within the set time frame.

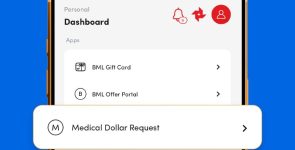

MIRA has facilitated the filing process by allowing returns and payments to be completed through their online portal, MiraConnect. For businesses that have not had any transactions during the specified period, they can file their GST statements via ‘VaaruPay’. MIRA emphasises the importance of seeking timely assistance if any challenges arise during the preparation or submission of tax returns.