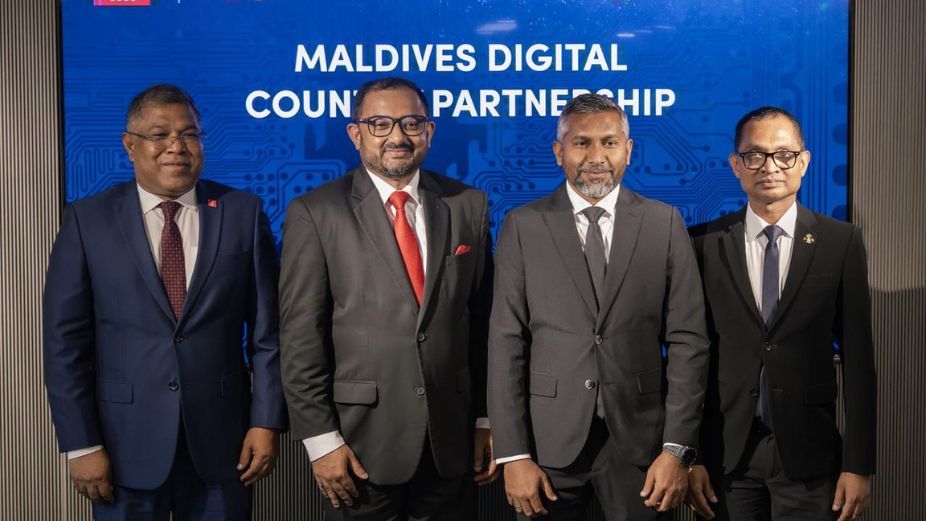

Mastercard has joined forces with Bank of Maldives (BML) and the Ministry of Homeland Security and Technology’s National Centre for Information Technology (NCIT) to launch the Maldives Digital Partnership Program, a five-year initiative aimed at accelerating the country’s digital transformation.

The programme is aligned with the Government’s vision of creating a digitally empowered Maldives, with Mastercard’s global technology expertise set to play a key role in modernising the nation’s digital infrastructure and expanding access to secure, efficient digital services.

Core objectives include upgrading digital identity and payment systems, enhancing cybersecurity through AI-driven solutions, and broadening the digital payments ecosystem by digitising government services and key sectors. Plans also include introducing advanced payment systems for public transportation and using data analytics to generate actionable insights for tourism and other economic drivers.

The collaboration is expected to contribute significantly to building a resilient, inclusive, and future-ready digital economy. Mastercard’s involvement is positioned as a major enabler in this transformation, supporting efforts to leverage technology for economic growth, transparency, improved governance, and enhanced citizen services.

BML highlighted the partnership as an opportunity to combine local expertise with Mastercard’s technological capabilities to create a strong digital foundation for the Maldives. NCIT underscored the programme’s alignment with the Maldives 2.0 initiative, which is designed to transform public services and strengthen the digital landscape.