One might wonder – in fact, individuals and businesses alike – why there are high rates of interest and significant difference between deposit rates and lending rate compared to other countries. The article intends to seek the challenges for individuals, businesses, the governing body and the banks itself. The goal is not intended to point fingers at institutions but to analyze and draw a conclusion about why this happens. The article is a collection of thoughts and comments from various facets of finance industry professionals.

When asked about it, one financial expert mused: “We have a lot of banking representatives here in Maldives, which is a rare profession. People really want to know why our bank rates are so high. Is there something wrong?”

The interest rate for loans is high for both individuals and businesses while the gap is wide for deposit rate and lending rate. For example, the interest on credit cards are extremely high at 35-40% while Bank loan interest rate is on average at 12%. Hence, creating challenges with increasing costs for both the parties.

A former Bank Executive who spent a couple of decades in the banking sector said: “Banks are happy as a business, but they have limited funds; and lending it to resorts is more profitable and returns good. That’s why they do not focus on other areas. At the end, its business. There could be a handful of companies that get extra privileges. Like 8-9% interest loans. Big ones. But that’s that. There should be a monitoring system to govern.”

This is indeed true. The Economist Milton Freidman said in his famous piece on New York Times that a firm’s main responsibility is to its shareholders. Friedman argues that the shareholders can decide for themselves what social initiatives to take part in, rather than have an executive whom the shareholders appointed explicitly for business purposes decide such matters for them. This is same for the banks in Maldives. It is important to find who the shareholders are and why the momentum has not changed over the decades of new governments.

A professional in the Islamic Banking sector said that it is extremely difficult for small and medium sized businesses (SMEs) get funds from institutions. Maybe because of the collateral.

“We need businesses to be on trust basis where banks also have more faith on their repayment,” he said. “Besides, imagine when you want to borrow funds for a firm which is going down, like a working capital, and then the bank expects you to have profit in the last 5 years.”

Despite majority owned by government in some banks, while rest are held by public, the rates are unreasonably high by design. A former Governor of Maldives said it was not impossible to redesign the mechanism and reduce the rates.

“It’s a business decision, keeping high rates, so that the government earn higher dividends, at the expense of the private businesses,” he said. “Another drawback is trust and how the legal system of Maldives work. The high uncertainty and mistrust towards the court system and the laws, and banks being unsure whether their risky loans will be recovered and so they charge the higher premium for the increased risk. Moreover, lending loans to the government for huge financial requirements has less risk than lending to the private sector.”

A representative of one of the leading Finance and Consulting firms said that the banking sector was tiny in Maldives compared to advanced economies, so, there is no economies of scale.

“That means margins will be higher while reserve requirements are also high,” he explained. “The proportion of money available from deposits to lend is low. Moreover, tax on profit for banks is 25% compared to 15% for other sectors. Besides, government is the biggest shareholder in some Banks. Therefore, either tax or dividend, most of earnings goes to the government as income. As the shareholder (owner) it’s not that eager to reduce the rates.”

Competition has provided benefits to the country, to some extent. This is evident in the telecommunication industry.

“The key banks in Maldives have good liquidity and funding and hence they don’t need to attract depositors by offering higher interest rates to get more funding,” a Senior Executive in the financial sector said. “And, unlike more developed markets, there is no competition between the Bank’s here in Maldives and each bank seem to be very comfortable with their customer base and deposit books and hence not doing anything to attract more deposits. Because there is one conservational banker while others are wholesale bankers. As a regulator, via MMA, the government could enforce Banks accepting higher rate of non-performing loan which is extremely low in their cases right now. This can be done by reducing lending rate and accepting riskier lending by banks for the betterment of economy or increasing investments.”

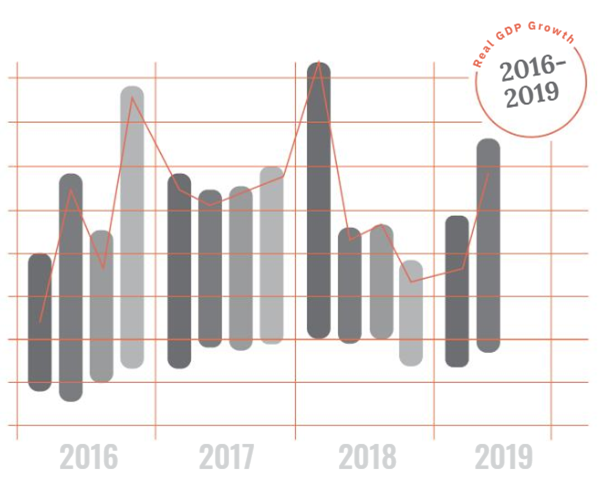

According to another professional in the Finance industry, Banks are financed by customers’ deposits. Seventy percent of bank financing come from customers’ deposits. Total customer deposits by 2018 is 33.2%, which is an annual increase of 8% per annum.

“Now you can see, that supply of funds increased and therefore based on law of demand and supply, deposit rates declined and averaged less than 1%, while lending rates remained the same, at 12 times more than the deposit rate,” he said.

Also, 25% of banking sector assets are in government (risk free) and the NPL is receding.

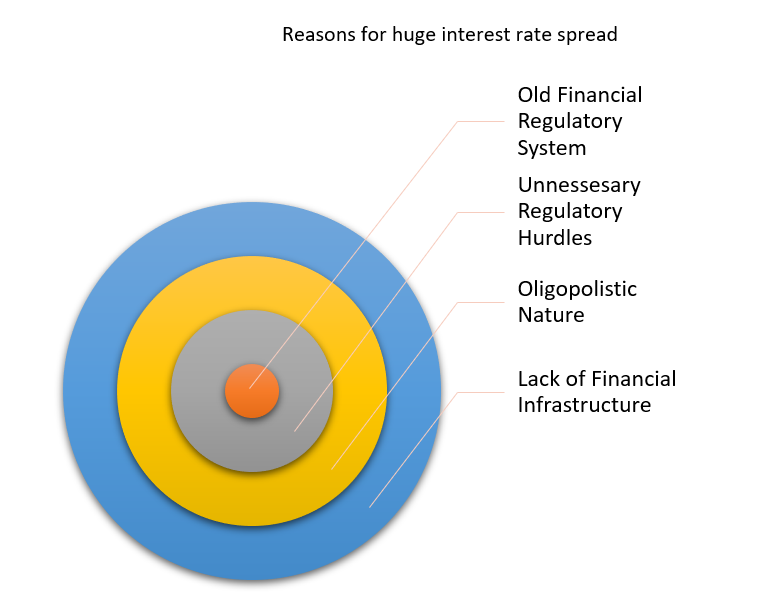

Reasons pertaining to the huge interest rate spread can be as follows:

1) The financial regulatory system is very old and fragmented. The banking law and securities act have too much emphasis of procedural and administrative matters rather than on the public welfare aspect and policy aspects. The banking law is very vague and restricts competition rather than encourage competition.

2) Too many regulatory hurdles and opaqueness in the securities act, hugely restricting other form of financial services. Also, the securities act requires all public sale of securities to be made available through stock exchange, which is a private entity. It is wrong and unfair to give preference to a private firm by force of law.

3) Oligopolistic nature and a dominant bank (national bank control 60% of the market) and as a profit maximizing entity there is no economic reason for them to lower the interest rates.

4) Apart from bank deposits, the only possible investment opportunity is government Treasury Bills (T-bill). However, T-bills are only accessible to banks, State Owned Enterprises (SOEs) and other government approved entities. Banks take advantage of this barrier to entry, attract funds from the market at less than 1% and invests in government securities, enjoying an arbitrage. This is because of lack of the financial infrastructure for securities trading; depository and recordkeeping services.

While there are problems to the banking system and issues related to the interest rate gaps, the article gathers some solutions to the problem. The following is suggested by the finance industry professional.

• Single financial sector regulatory framework: The Financial Services Act, which holistically address all aspects of the financial system in the country; lenders/borrowers/infrastructure/distribution aspects/reporting/micro and macro-prudential aspects.

• Mortgage lending to be separated from commercial banking

• National Payment system (a partnership with all financial firms, like the SWIFT system) rather than some banks dominating the market, which makes switching cost expensive for customers.

• Government to establish a fund to encourage savings which directly invests in T-bills rather than getting funding from banking sector.

• Community banking/establish unit trusts/credit unions/building societies/trade finance. Under the current financial sector regulatory framework, only banks and securities are addressed, insurance/leading/mortgage financing is addressed through MMA act.

• MMA to provide more avenues for banking sector liquidity management. The Lombard facility interest rate is too high, so banks also take a huge risk when they cannot meet the liquidity requirements through the inter-bank market.