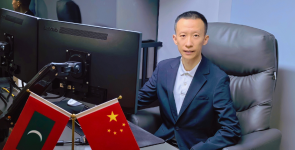

Mr. Abdul Wahid Thowfeeq is one of the pioneers of the Insurance Industry of Maldives and Managing Director of Dhivehi Insurance Company Private Limited, a 100% Maldivian insurance company that defines itself as a customer oriented company by positioning customer at the very heart of all its operations.

With over 20 years of experience, Mr. Wahid served as the MD of Allied Insurance for 6 years and is the proud owner of the title of first qualified insurance professional in the Maldives. Corporate Maldives sat down with Mr. Wahid to discuss his emergence into the industry, his plans for the future of Dhivehi Insurance and his advice for budding entrepreneurs.

How did you get started with your career?

I began my career at the age of 21 years, both with my private business and at Allied Insurance at the same time as an officer. When I began working in Allied Insurance I wasn’t fully aware of the full scope of the Insurance industry. There were only six employees in the company and I was the youngest one there. They offered me the opportunity to study and further my knowledge in insurance and even when I accepted, I didn’t realize the full scope of it. As I studied and as I continued working in industry, I became both more interested and more aware.

We had a small team back then, as I mentioned before, and it created a sense of ownership and the need to multitask. It gave me a greater understanding of both my work, and of other businesses in other industries as well, as when clients approached us for insurance we were required to conduct an assessment to evaluate their condition in order to calculate the risk. It increased my awareness of the different and diverse business sectors of the country. I’ve always found it very inspiring to see a business from startup to growth and finally finding its place in the industry.

I worked at Allied Insurance for 20 years, and also fulfilled the position of Managing Director for 6 years. I was the first MD to have a background and technical expertise of Insurance. Insurance is a very specialized business and it is important to understand the technical aspects, especially in the context of Maldives as new products have to be introduced while at the same time closely monitoring the progress of the new products. It requires for the MD to work very closely together with the technical team to ensure success.

What are some of your notable successes?

While at the helm of allied, there were several changes I am proud of. During my tenure, initiatives taken led to Allied evolving from a commercial insurer to an insurer that serves individuals of the public. I take pride in the progression from a focused insurance company to a broad insurance company, and special projects such as Aasandha rollout and the development of a broad IT platform, which was conducted under my leadership.

I consider my milestones to be progressive. At any stage in my career, my end goal is to progress to the next goal while utilizing the resources at hand that day to create the best value for the next day. Dhivehi Insurance is a big step in this direction; establishment of the company, the products that we offer are all progressive milestones that are new and will create value.

What are some challenges that you have faced?

Aasandha was a very new scheme, and the time we had to rollout was quite short. IT systems were required to be developed in-house. My attitude on business is that it should be progressive not waiting for perfection. We began with the means we had and gradually improved it. My team met this challenge head on and rolled to cater to the new requirements, and broadened it to the level it is now.

Dhivehi Insurance was an idea that I had a long time back, when I noticed many happenings in the market that I felt needed to change. One of these was developing the market environment; it is necessary to have multiple companies focused on long-term goals to develop a market.

I always enjoyed new challenges, and so, 3 years after leaving Allied, I incepted Dhivehi Insurance. It is vastly different to work in a private owned company versus government owned. In a private company there is more sense of ownership, decision making is much faster, and in a dynamic environment I feel faster decision making is important and we are able to respond to changes in the market faster. However, the resources at a new company is limited, and so it is necessary to optimize the limited resources to get the best results.

Personally, this is not a role which I have done for the past ten years, as I previously had the support of an extensive management team. At the helm of a foundling company, I am learning new things every day and have to take a larger role in the leadership which I feel like is a good change, as it made me revisit some of the old ideas and have to take a more personal role in the development.

What do you do differently at Dhivehi Insurance, and what are your plans for the future?

There is a lack of awareness within the public not only about insurance, but financial literacy, both in banking and insurance sector. We have to improve the level of financial literacy to be able to penetrate the market further, and so we at Dhivehi Insurance feel a market responsibility to improve the awareness of the public and the customers. We produce documentations in laymen terms for the public for their ease of understanding, as well as organizing a series seminars and awareness programs to educate the public about innovative insurance products, such as corporate liability.

As an insurance company, our end goal is to service all of the public, but we should also have a strategy. It isn’t possible to serve every individual in the country from day one. Our primary focus at the time is corporate businesses; we want to take a holistic approach to the market, not as a company selling insurance products to customers but as a company that gives a complete solution to be considered a long-term partnership.

We will continue improving our products while introducing more products such as liability insurance, contractors’ insurance, and other specialized insurance classes not present in the market currently. We want to create more value for the customers, as there are products that are needed by customers but not readily available in the market. We would like to be eminent in specialist area of the industry offering specialist products for the people.

As we continue to expand, we will be penetrating the individual insurance sector and try to cover the entire population with different insurance products. Our goal is to develop and deliver superior specialty insurance products that are correctly priced to meet our client’s needs.

What is your advice for young adults interested in entering the Insurance Industry?

If you want to begin any career, you need to have a long term perspective. Keep in mind that you cannot reach your goal in a day, it takes time. You wouldn’t be able to understand how things develop until you begin, and an outsiders’ perspective isn’t enough to understand the industry. Once you begin, you would be able to understand and develop your knowledge.

Everyone has skills that can be utilized if they are keen to develop themselves. I don’t believe in repeated failure. Of course some failure is inevitable, but the lessons you learn when you fail should teach you how to go about succeeding. Use your failures and turn them into successes, apply yourself and make a change.

All markets are becoming competitive and this is the opportunity for those who face it with differentiation strategies to create a differential value for the customers. Ultimately those who succeed are the ones who are dynamic and adaptable to a changing environment. The proprietary advantage will be your brand, the appeal and the value that customers attach to you which is not necessarily the asset value on your balance sheet.