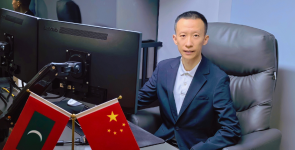

Mr Ahmed Ameel is one of the pioneers of the insurance industry in Maldives with over 20 years of experience. He began carving himself a pathway into the emerging industry right out of school and is now credited with bringing revolutionary changes to how insurance service providers operate in the country and also changing customers’ initial negative perception of the benefits of insurance. Corporate Maldives got to meet with Mr. Ameel and talk about his career with Allied Insurance Company of the Maldives.

Tell us a bit about Allied Insurance and how you got your start there.

Allied Insurance Company of the Maldives was formed on the 1st of November 1984, but it was a relatively a low-key operation at the beginning, since we only had a few key clients. The Company wasn’t well known by the mainstream business community. In an effort to develop the company and the insurance industry as a whole, the Government brought in a consultant from the United Nations in 1992 with the financial assistance provided by the UNDP. The goal was to create a new business model and a strategy to make the company better and to make insurance more commonly known and widely available to the public. In 1994, under the guidance of the consultant, Allied Insurance started hiring new staff to handle the company’s day to day operations. On July 1st that year I was lucky enough to be selected among the three new recruits, one of whom is now currently our Deputy Managing Director and another colleague.

As a freshman just out of high school with no experience whatsoever, I plunged myself into work anyway, not knowing what insurance was or its place in the larger scheme of things. I had applied for the job just for the sake of getting a job. At the time, I did not have even a passing interest in what the company was really about. It was a simple operation and, including the current new recruits, there were only five staff members. The office was tiny even for just the five of us but we had a great rapport going on even from the beginning. The atmosphere was fun and working there was very enjoyable. Eventually, I found that I was actually taking an interest in my job, getting more and more involved in the day to day operations, and even trying to learn more about insurance and how it worked. The superiors were really nice people and very helpful. They tried to cultivate a work atmosphere that was conducive to learning even for those who had zero experience. That’s why I decided to stick around and see where it would take me.

The decision was a good one, as even after almost 20 years I am still here. After the first few months of trying to familiarize ourselves with the company’s operations on our own, we got the opportunity to get professional training from India. Even though I had learned a lot from my superiors prior to that, the training I underwent in India was my first real exposure to the basic fundamentals of insurance and it really opened up my eyes. However, after returning to Maldives I realized that it was very difficult to apply the lessons I had learnt because at the time the business industry in Maldives was not very developed and most clients did not see the need to insure anything. Not surprisingly, we only a had a few clients. But that was probably a good thing because this meant that even with the staff we had we could attend to each and every client directly, giving each of our interactions with them a very personal touch. Our relationship with the clients grew very strong because of this.

It was around this point that I realized that our country and the business industry could reap immense benefits from our services. Insurance had no limitations or boundaries so I decided to pursue it seriously as a career and build a future for myself and the company.

What were the initial challenges you faced?

The biggest challenge when we got started was the people’s mindset. Insurance at the time was viewed as a liability, not a benefit. This was the case until the Tsunami of 2004. Then everything changed. This was one of the worst disasters in the history of the country and it was the first time that companies had to deal with loss on a such a massive scale. The Tsunami was the catalyst that sparked the change in the Maldivian mindset. Before the waves washed away everything, the society’s attitude towards insurance was very negative. Even our best efforts at trying to make most clients see the benefits of insuring were only marginally successful as people just couldn’t be persuaded to insure their businesses or properties since they believed the risk of a major disaster was just too low in the country. Before the tsunami, we held workshops and individual one-on-one meetings with clients to spread awareness. It did obtain some customers but there were still many barriers. In the tsunami’s aftermath everyone began to see the benefits of insurance and how important it was, and it changed everything for us.

In terms of talent and human resource, we find it hard to recruit insurance savvy staff. So we started recruiting interested talent right out of school and training them. We have found that rather than hiring qualified staff at a later age or hiring from abroad, young new recruits, if nurtured well are more of an asset to the company. We train and provide additional training abroad for our staff and this gives us the opportunity to have a pool of guaranteed talent for us to choose from. This also creates a sense of belonging and an attachment from their side to the company. Time after time our method of hiring young energetic staff has proven to be a major success.

How do you stay on top of the game in such a competitive environment?

We have always kept a really close bond with our customers and try to add a personal touch for each individual customer. Be it advice or a property valuation. Sometimes, we even give these services for free just to build relationships and make them feel at home with us. Claim settlements are the biggest part of any insurance firm. This is when insurance is put to the test and we always come out on top and satisfy the customer. We have made the company and services very much accessible with a call center and online portals for our services.

After the tsunami, our customers had claimed and received more than $1.5 million by the 1st of January 2005, just a few days after the tsunami struck. We make it our mission to deliver and keep our customers happy as this is essential for our success in the long run.

What do you consider to be Allied’s biggest accomplishment?

Our biggest accomplishment is the growth of the industry as a whole. With new players arriving on the playing field constantly, we have a lot of healthy competition. And this automatically brings out the best in us and we try to provide a better service than our competitors. One of the things we are very proud of is the staff we have trained, moving on and starting to work at other firms. It shows that we have managed to establish a great training ground and a hub of innovation in the industry. For us to be on top, it is essential for other Companies to create an atmosphere of healthy competition. To see our groomed staff challenging us later on is our biggest accomplishment.

Where do you see yourself and your company in the next decade or so?

As insurance is a borderless industry we have to go international and branch out from the restraints of operating locally. Our international operations will begin soon and that’s a fact. There are countries even less developed and with smaller economies than us to go out and expand internationally as insurance providers. This gives us hope that we can have a sizeable operation in the region. There is a window of opportunity for us and hopefully we’ll become an international company by the end of this year. Our economy is growing and to fully benefit from it we must grow and provide all our services internationally as well. I can see all the ingredients to make this a reality in the horizon and I have no doubt that we can achieve this.

One last thing. A word of advice to those who are new to the industry or looking to pursue a career, not just in this industry but any industry. Don’t view your job as just a job. View it as a career. Especially if you’re in the service industry. You can always get a job but a career is really hard to build. Finish school and try to find what you’re good at, stick to it, develop it and you can become a successful person. It’s a guarantee!