Bank of Maldives reported positive financial performance for the first quarter of 2021 with a Profit

After Tax of MVR 357 million, up 23% on the same period last year. The Bank’s performance this quarter reflects good recovery in all its core business lines from the significant impact of the Covid-19 pandemic last year.

Operating Profit for the quarter amounted to MVR 537m, up 25% on the same period last year. This was driven by solid business volumes across all key sectors. Capital and liquidity remains solid and well above regulatory requirements.

BML’s network expansion and community investment program continued during the quarter with new Self-Service Banking Centres opened in K. Guraidhoo and M. Muli. During the quarter, five Community Fund projects were awarded as part of its wider initiatives to support the community. The Bank also launched a new ‘Samaaluvey’ campaign to increase awareness and prevent financial fraud.

BML’s CEO and Managing Director, Tim Sawyer commented, “We are seeing encouraging signs of recovery post-Covid with good performance from key business lines including card income. While we continue to be cautious in our outlook for the year, we look forward to supporting our customers and communities with investments in network expansion as well as new products and services.”

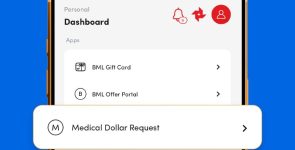

With a nationwide network of 35 branches across all 20 atolls, 71 Self Service Banking Centres, 132 ATMs, over 200 agents and a full suite of Digital Banking services, Bank of Maldives is committed to supporting individuals, businesses and communities across Maldives.