The Maldives’ tourism industry has been thriving with record visitor numbers, yet one notable weak spot has emerged: tourist arrivals from India are in decline. Once the largest source of tourists to the Maldives, the Indian market has seen a sharp drop in the past year.

This trend continued into early 2025, raising concerns in Malé about lost revenues and prompting high-profile efforts to win back Indian travellers. In this analysis, we examine the latest tourism statistics (including March 2025 and 2024 data) to understand the downturn in Indian arrivals, compare India’s performance with other key markets (China, Russia, the UK, and Germany), and evaluate whether a new partnership with the Mumbai Indians cricket team might help revive Indian tourism to the Maldives.

Tourism Boom and Shifting Source Markets (2024–2025)

The overall tourism picture for the Maldives remains robust. The country welcomed over 2 million tourists in 2024, surpassing the previous year’s 1.88 million and setting a new record. This was a 9.1% increase from 2023’s total of 1,878,543 visitors. Growth has carried into 2025 as well – by mid-March 2025, arrivals were running about 4–5% higher than the same period in 2024. These gains have been driven by a rebound in travel from many markets and expanded flight connectivity. Notably, China’s return to outbound travel has reshaped the Maldives’ tourist demographics. After China lifted travel restrictions, Chinese visitor numbers surged, and China reclaimed its historic position as the Maldives’ top source market in 2024.

Table 1 – Top Source Markets for Maldives Tourism: 2023 vs 2024 (annual arrivals and market share)

| Source Market | 2023 Arrivals | 2023 Share | 2024 Arrivals | 2024 Share | Change 2023→2024 |

|---|---|---|---|---|---|

| China | 187,125 | ~10% | 263,340 | 12.9% | +40.7% |

| Russia | 209,146 | 11.1% | 225,204 | 11.0% | +7.7% |

| U.K. | 155,994 | ~8.3% | 181,644 | 8.9% | +16.4% |

| Germany | 135,091 | ~7.2% | 157,246 | 7.7% | +16.4 |

| India | 209,193 | 11.1% | 130,805 | 6.4% | –37.5% |

As shown in Table 1, there were striking changes in the Maldives’ tourist composition between 2023 and 2024. India’s ranking plunged from #1 in 2023 to #6 in 2024. Indian arrivals, which exceeded 209,000 in 2023 (about 11% of total tourists) fell by roughly 37.5% to just 130,805 in 2024. In contrast, China vaulted to the top with 263,340 visitors in 2024 (12.9% share) after a 40.7% surge, thanks to resumed flights and pent-up demand. Russia maintained a strong second place with 225,000+ visitors (about 11% share), slightly up from 2023. Traditional European markets like the UK and Germany also saw growth in 2024, each contributing around 8–9% of tourists. By the end of 2024, the Maldives’ top five source markets were China, Russia, the UK, Germany, and Italy – with India notably absent from the top five for the first time in years.

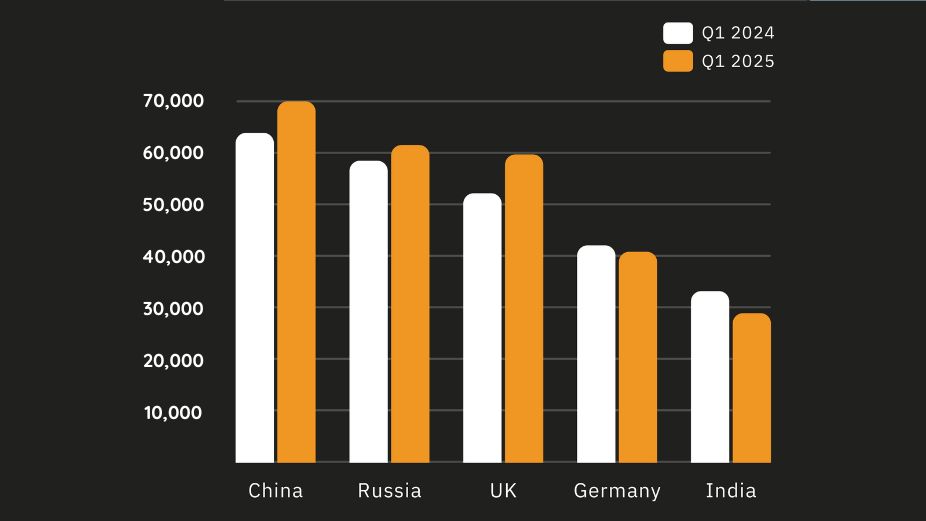

The start of 2025 has reinforced these trends. By March 2025, China and Russia remain on top, while India’s position is still subdued. As of March 24, 2025, India accounted for only 5.0% of tourist arrivals (ranked 6th), compared to about 5.9% by the same point in 2024. In absolute terms, 28,942 Indian tourists visited the Maldives from January 1 to March 24, 2025, whereas 33,336 had visited in the equivalent period of 2024. This ~13% year-on-year decline in the first quarter of 2025 illustrates the continuing weakness of the Indian market. Meanwhile, other major markets have grown or held steady – for example, Chinese arrivals in Q1 2025 were up by around 9%, and UK arrivals by about 14%, versus Q1 2024.

The bar chart in Figure 1 illustrates the contrast. India is the only one of the Maldives’ top five source countries to see a drop in tourist numbers year-on-year in early 2025 so significantly, whereas countries like China, Russia, and the UK have sent more tourists than they did in early 2024. This is a dramatic reversal for India, which just a year or two ago was leading the Maldivian tourism rankings. In fact, from 2021 through 2023 India had consistently been the number one source market, with over 200,000 Indian tourists each year. That streak ended in late 2024 as China overtook India, and the gap has only widened since.

Why Indian Arrivals Are Declining

Several factors help explain India’s downturn in the Maldivian tourism market, ranging from geopolitics to competitive travel trends:

Geopolitical Strains and Boycott Calls: Perhaps the most immediate factor has been a diplomatic rift between the Maldives and India in late 2023. Tensions arose after Maldives’ newly elected President Mohamed Muizzu pursued an “India-out” policy (including calling for the removal of Indian military personnel stationed in the Maldives) and Maldivian officials made derogatory remarks about India’s leadership on social media. This sparked public outrage in India. By late 2023, Indian social media saw calls to #BoycottMaldives for vacations. The impact was swift and tangible – travel agencies reported thousands of cancellations by Indian holidaymakers, and at least one major Indian online travel portal even suspended Maldives bookings in protest. Indian arrivals began dropping sharply in the final months of 2023 as many Indians chose to skip the Maldives amid strained relations. Maldives ended 2024 with 42% fewer Indian visitors than the previous year, reflecting this fallout.

Airline Connectivity and Access: Normally, the Maldives is easily accessible from India, with frequent flights from major Indian cities (Mumbai, Delhi, Bengaluru and others) to Malé. In fact, air connectivity has improved in recent times – for example, new routes by Air India and other carriers were launched in 2023–2024 to boost travel to the Maldives. Thus, the decline in Indian arrivals is not due to lack of flights or visa barriers (the Maldives offers visa-on-arrival for Indians, and Maldives recently began accepting India’s RuPay card for easy payments. If anything, connectivity remains strong; the issue is a drop in demand. Some airlines and resorts have reportedly seen lower occupancy from India and may have reduced their marketing in India following the slump. Overall, flight access is not the bottleneck – Indians can get to the Maldives, but fewer are choosing to go.

Competition and Changing Travel Preferences: The Maldives faces growing competition for Indian tourists from other destinations. During the pandemic, the Maldives was one of the few tropical destinations open without onerous restrictions, attracting large numbers of Indians in 2020–21. Now, with global travel fully reopened, Indian travellers have many alternatives. Other Asian beach destinations such as Thailand, Indonesia (Bali), and the Dubai/Middle East region are all vying for Indian tourists with aggressive promotions. Even Lakshadweep and the Andaman Islands (India’s own tropical isles) are being promoted as cheaper or controversy-free alternatives to the Maldives. Additionally, long-haul travel to Europe and the Americas is back on the radar for affluent Indians. This diversification of Indian travel choices has naturally diluted the Maldives’ share. The Maldives is a high-end destination – if Indian consumers perceive a less welcoming climate or higher prices, they can pivot to other locales for their holidays.

Economic Factors and Cost Considerations: The cost of a Maldivian vacation (often luxury resort packages priced in US dollars) may be a deterrent if the Indian rupee is weak or if airfares and hotel rates have risen. Inflation and currency depreciation mean a Maldives trip in 2024–25 would cost an Indian family more in rupee terms than it did a few years ago. With the global rise in travel costs, price-sensitive Indian tourists (especially the growing middle-class segment) might opt for domestic tourism or more budget-friendly countries. The recent downturn in Indian visitors could partly indicate that the Maldives is losing some of the price-conscious segments of Indian travellers, even as it retains ultra-luxury clientele. It has been estimated that the decline in Indian arrivals over the last year cost the nation around USD 60 million in lost earnings – underscoring the significant economic impact when a major market pulls back.

Seasonality and Timing: It’s worth noting that Indian visitor numbers to the Maldives tend to peak at different times than European markets. Industry experts point out that Indians often travel during India’s hot summer months (April–June), which is the Maldives’ off-peak season, thus helping to fill resorts when European arrivals dip. The current stats (Jan–Mar) represent what is usually the high season for Europeans; Indian arrivals might naturally be lower in these months even in normal times. There is hope that by mid-2025 (the summer holiday period in India), Indian bookings could pick up if relations improve or if attractive deals are offered. However, given the underlying sentiment issues, a significant rebound in the coming off-season is uncertain. Hoteliers fear that if Indian travellers don’t return even for the summer, the Maldives could feel a painful gap during those months that Indians usually help fill.

Political and perception issues have been the primary drag on the Indian market, exacerbated by plenty of other choices for Indian tourists in a post-pandemic world. The Maldives finds itself needing to rebuild its image in India and recapture the attention of Indian travellers who have drifted away.

Courting India Anew: Visit Maldives Teams Up with Mumbai Indians

To counteract the decline and re-energize demand, Maldives’ tourism authorities have launched targeted initiatives for the Indian market. The most headline-grabbing effort is a new partnership with the Mumbai Indians, one of India’s most popular cricket teams. In March 2025, the Maldives Marketing and Public Relations Corporation (MMPRC, branded as Visit Maldives) announced a deal making the Maldives the “Official Tourist Destination Partner” of the Mumbai Indians for the 2025 Indian Premier League (IPL) season, one similar to the deal they had done with the English football club Liverpool. This is a first-of-its-kind campaign for Maldives tourism in India, signaling how crucial the Indian market is despite recent challenges.

Under this partnership, Visit Maldives will run a series of promotions leveraging the Mumbai Indians’ brand and fanbase. Cricket is the most-watched sport in India (and the second most-watched globally), and Mumbai Indians—five-time IPL champions—command a huge following. The idea is to tap into that audience through digital campaigns, on-ground activations at matches, player endorsements, and exclusive travel offers connected to the team. For example, one could envision Maldives vacation giveaways for contest winners, Maldives branding in the stadium and on social media, and content featuring Mumbai Indians players vacationing in the Maldives’ luxury resorts. By associating the destination with beloved cricket heroes, Visit Maldives hopes to inspire Indian fans to consider a Maldives holiday – especially the higher-income segment of viewers that advertisers covet.

Importantly, Visit Maldives has set an ambitious target of attracting 200,000 Indian tourists in 2025. That would essentially restore Indian arrival numbers to their pre-decline peak (recall that 209k Indians visited in 2023). The Mumbai Indians partnership is seen as a key pillar in achieving this goal.

Maldivian tourism officials believe that the emotional connection to cricket, combined with the Maldives’ natural appeal (pristine beaches and resorts that are already famous among Indian celebrities and honeymooners), can rekindle interest and overcome recent negative perceptions.

Will this strategy work? There are reasons for optimism. The Maldives enjoys a strong brand recall in India – it’s known as a glamorous, aspirational destination and was even something of a Bollywood celebrity hotspot during the pandemic travel bubble. The marketing blitz during IPL will remind millions of Indians of the Maldives’ charms at a time when summer vacation plans are forming. It also helps that the Maldivian government is visibly trying to reset ties with India: for instance, President Muizzu, during a visit to India in 2024, openly invited more Indian tourists and even hosted Bollywood stars at an event to promote Maldivian tourism. The fact that contentious government officials in President Muizzu’s administration were removed and moved to SOEs, and the government distanced itself from anti-India remarks, shows a course-correction to mend relations. These diplomatic signals, combined with the Mumbai Indians campaign, could reassure Indian travellers that they are indeed welcome and valued in the Maldives.

However, marketing alone may not be a panacea. Some tourism analysts caution that as long as political undercurrents remain (or if any new Maldives-India flare-up occurs), a segment of Indian tourists might stay away regardless of advertising. The #BoycottMaldives sentiment, while perhaps cooling, might not vanish overnight. Additionally, the Maldives faces intense competition – other destinations are also courting the Indian outbound market with sports tie-ups and ad campaigns. The Maldives will have to ensure its message stands out and that it offers value that convinces Indians to choose it over the alternatives.

Early responses to the Maldives–Mumbai Indians partnership have been positive in industry circles. Tourism stakeholders see it as a smart move to blend sports marketing with destination promotion, something countries like Rwanda (“Visit Rwanda” on an English Premier League jersey) and Dubai (Expo 2020 on IPL team jerseys) have done successfully. If the campaign converts a good fraction of Mumbai Indians’ enormous fanbase into Maldives visitors, it could significantly buoy Indian arrival numbers later in 2025. Even travel agents who had boycotted Maldives may be encouraged to resume promotions if they sense demand returning. The Maldivian tourism sector, from resorts to guesthouses, would certainly welcome a revival of the Indian market, as it provides a critical volume of visitors especially in the off-peak months. Some estimates suggest the Maldives could be foregoing up to USD 1.8–2.0 billion in tourism revenues if Indian arrivals remain depressed at current levels, which explains the urgency behind such high-profile recovery initiatives.

Outlook: Cautious Optimism for a Rebound

The current state of the Indian market in Maldives tourism is one of caution and concerted effort. The data paints a clear picture: Indian tourist arrivals have declined significantly, even as overall Maldives tourism is booming with other markets. India went from being the Maldives’ top source of tourists for three years running to an outlier in decline. This has been a wake-up call for the Maldives’ tourism authorities and businesses, who feel the pinch of fewer Indian guests in resorts and planes.

On the positive side, steps are being taken to reverse the slide. The new partnership with Mumbai Indians is a bold and creative marketing gambit that, if executed well, can boost Maldives’ visibility and appeal among millions of Indians in 2025. Combined with diplomatic rapprochement and the Maldives’ inherent strengths as a destination, there is a real chance to restore India’s place in the Maldives tourism mix. We may see the impact of these efforts in the coming months – for instance, Indian visitor numbers during the summer holidays and the Diwali festive season will be key indicators of whether the market is bouncing back or not.

Maldives will also continue to diversify its outreach (tapping not just cricket, but also film, social media influencers, and trade roadshows in India) to rebuild demand. In the meantime, other source markets like China, Russia, the UK, and Germany are compensating for the dip in Indian arrivals, keeping Maldivian tourism on a growth trajectory for now. The Maldivian economy and corporate sector – heavily dependent on tourism – will be watching closely, as a sustained recovery in the Indian segment would not only bolster visitor totals but also strengthen offseason revenues and people-to-people ties between the two countries.

For an economy that earns over 60% of its foreign currency from tourism, every market counts. India’s slump has been a rare blemish in an otherwise strong tourism story. If the current initiatives bear fruit, industry analysts expect India could climb back up the rankings in 2025 or 2026, perhaps even rivalling China and Russia once more. The Maldives is essentially sending a message: “Dear Indians, you are welcome here”. The coming year will reveal how many Indians respond to that message by packing their bags for the Maldives’ sun-soaked atolls once again.