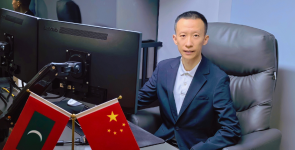

Mr. Fathuhulla Jameel is the Commissioner General of Taxation at Maldives Inland Revenue Authority (MIRA), an independent legal entity tasked with the implementation of taxation policies in the Maldives. Our team sat down with Mr. Fathuhulla to find out more about the work being carried out by MIRA, and various tax-related issues facing the country today.

Could you begin by explaining the scope and mandate of MIRA?

The primary mandate of MIRA is the implementation of tax policies and enforcement of tax laws. Like most modern tax systems, the tax system in the Maldives is a self-assessment system whereby the taxpayers are actually primarily responsible for registration, declaring the correct amount of tax payments, as well as filing and making them.

MIRA is required to make sure that taxpayers do register when they are required, as well as make sure the correct amount of tax is declared and made when it is due. MIRA is also mandated to ensure that the taxpayer’s rights are adhered, to as well as give full information to the taxpayers about laws and regulations, and responsibilities of the taxpayers, so that they can fulfill their rightful obligations in a correct and accurate manner. In addition to that, MIRA is also required to implement the tax system in such a way that the cost for the taxpayers is minimized as much as possible, and that the administration of the implementation is done in the most economical way as well.

The COVID-19 pandemic greatly affected the Maldivian economy. From the perspective of tax collection, how swift has recovery been?

We actually have been recovering quite swiftly considering that, for example, in 2021, we were able to collect more than 50% of what we were able to collect in 2020. This shows that the trajectory of recovery is positive, which can mainly be attributed to the efforts from the tourism industry – about 75% of the total revenue collection through MIRA is directly or indirectly related to the tourism industry. Based on recent statistics, you will see now that the tourist arrival figures and bed night sales have increased tremendously compared to that in 2020.

So, what I would say is that recovery has been better than expected in 2021. However, I would note that there are some industries which are still slightly struggling to make their way back to pre-pandemic levels.

How significant of an issue is tax evasion in the Maldives?

Most taxpayers do comply and give cooperation to MIRA. But there are some taxpayers with whom we need to make full force of the law. It depends on the industry and the sector as well. For example, most large businesses would have professional tax advisors helping them to do the tax planning. We need to make sure that that those tax plannings are not directed towards tax avoidance or tax evasion, and that the corrective remedial actions are taken in that case.

In addition to that, there are some taxpayers, usually smaller or the medium range taxpayers who are not fully aware of their obligations. Such taxpayers may be prone to making mistakes, even when they are trying to fully comply with the laws. For those, we try to give education and awareness.

There are also certain cases where we have actually found GST fraud. Basically, the taxpayers who have registered with MIRA, or even without registering, charge GST from customers but either do not declare GST at all, or declare an incorrect amount of GST to MIRA.

What is being done by MIRA to increase public awareness about tax-related issues?

I would say that we do a lot to make sure that the taxpayers, as well as the general public, are aware of their obligations and responsibilities, but there is still more that needs to be done on that front as well.

We have our media across all mediums of mass communication. For example, we have advertisements and TV commercials, as well as some TV programs. We cover the online news platforms, and our social media presence is relatively strong. In addition to that, we have information sessions that are available for all.

We also have a dedicated hotline for the taxpayers and also the general public, if they want to get any information in relation to any tax matters. My recommendation for taxpayers, as well as the general public, is that if they want any information or clarification regarding any tax matters, is to simply reach out to us. We are here for you.

How is MIRA utilizing technology to make the taxation and payment processes easier?

Most of MIRA’s services, if not all of them, are now available online. For example, taxpayers can get information through our website as well as our online platforms. They can make their payments and file their returns through our MIRA Connect application. If they are not basically a regular payer to MIRA, they still pay their fees (vehicle fees, service fees, etc.) through our Vaaru Pay option as well. Another significant aspect is our website, which is very lively and regularly updated. So, the online options are available to the public to make tax-related processes much more convenient.