The World Economic Forum’s latest white paper on quantum technologies in financial services outlines a coming shift in how banks, insurers, and asset managers operate. From portfolio optimisation to ultra-secure communications, quantum technologies are no longer distant science fiction. They are rapidly maturing tools. As global financial centres move towards this quantum future, the Maldives must ask: what role will it play, and how should its financial institutions prepare?

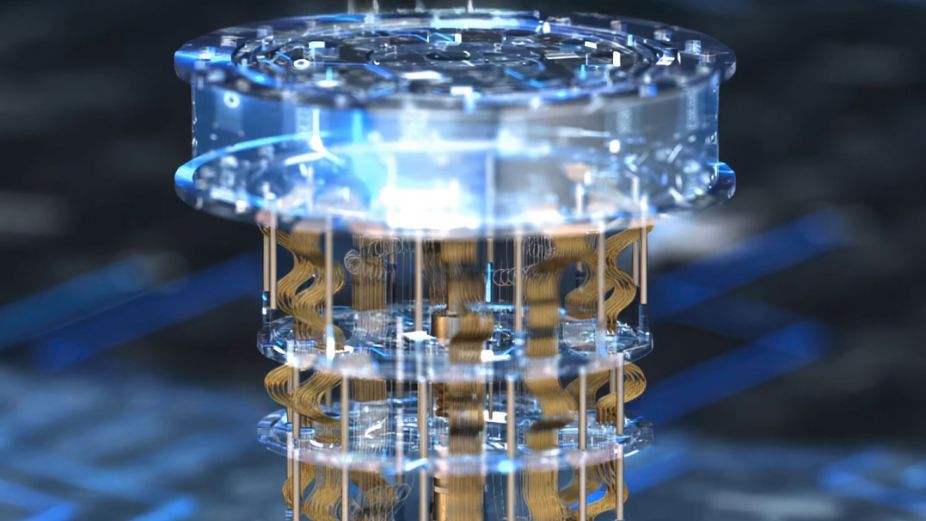

The report identifies three main branches of quantum technologies that are reshaping finance: quantum computing, quantum sensing, and quantum security. Each holds transformative potential. Quantum computing, for instance, can run simulations and calculations far beyond the reach of traditional computers, enabling more accurate risk models and faster fraud detection. Quantum security technologies such as post-quantum cryptography (PQC) and quantum key distribution (QKD) are being developed to protect financial data from future quantum-enabled cyberattacks. Meanwhile, quantum sensing could one day improve high-frequency trading and even ESG reporting.

Banks in Europe and Asia are already experimenting with these applications. Yapı Kredi in Turkey used quantum computing to detect hidden risks in SME credit networks. Intesa Sanpaolo in Italy applied quantum machine learning to enhance fraud detection accuracy. HSBC has incorporated quantum technologies into its digital asset infrastructure. These are early but serious moves that signal a shift in how financial services manage complexity and security.

What does this mean for the Maldives?

Although Maldivian financial institutions may not be investing in quantum research just yet, they are not immune to its ripple effects. Cybersecurity in particular will become a pressing issue. As the report highlights, current encryption methods will eventually be rendered vulnerable by quantum computers. This makes post-quantum cryptography not just an option but a necessity for future-proofing. Banks operating in or interacting with international systems, especially through SWIFT, correspondent banks, and digital payments, will need to adopt quantum-safe standards or risk exclusion.

Regulatory bodies in the Maldives should begin preparing now. This includes assessing the quantum-readiness of the financial system, participating in global cybersecurity standards, and potentially developing a national strategy for quantum risk mitigation. Central banks in other countries, like Singapore and Israel, have already issued advisories and roadmaps. Even small economies will be expected to meet the minimum thresholds of quantum resilience in the years ahead.

There’s also a growth opportunity. The Maldives could position itself as a testbed for fintech applications that integrate quantum-inspired algorithms. While developing original quantum technology may be far-fetched, leveraging it through partnerships, for example with regional hubs like Singapore, could bring competitive advantages. Tourism and fisheries are data-rich sectors that could benefit from more advanced modelling tools.

Of course, talent is a barrier. The report calls for urgent upskilling and cross-disciplinary education at the intersection of quantum physics, finance, and software development. This is a challenge for all countries, but especially for small ones like the Maldives, where niche expertise is harder to grow and retain. Collaborations with international universities, scholarships, and pilot programmes can begin to close the gap.

The Maldives may not be designing quantum processors, but it cannot afford to ignore their consequences. Whether it is preparing banks for new cybersecurity standards or exploring innovative fintech partnerships, quantum technologies will shape the next phase of financial evolution. The time to begin asking how we fit into this picture is now.