The Maldives Stock Exchange (MSE) has achieved a significant milestone with the launch of its first-ever online Automated Trading System, marking a new chapter in the nation’s securities market. Unveiled on the Exchange’s 17th anniversary, the system revolutionises trading by allowing real-time transactions of listed securities.

A Leap in Trading Infrastructure

At the heart of this innovation lies the Order Management System (OMS), a web application enabling brokers to submit investor orders directly to the Stock Exchange. The OMS ensures that orders are instantaneously communicated to the trading board and matched in real-time, enhancing efficiency and transparency.

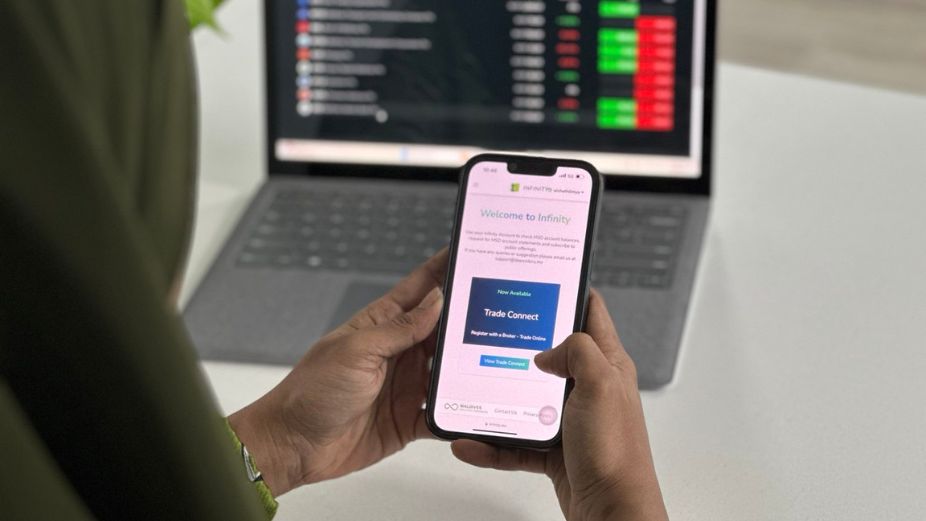

Complementing this system is the “Trade Connect” feature, introduced by the Maldives Securities Depository (MSD) on the Infinity platform (accessible via https://infinity.mv/). This feature enables verified users to log in, select a broker, and execute trades seamlessly online. With this advancement, investors can access market services at their convenience, submit trade requests, and track transactions with ease.

Years of Innovation

MSE, licensed by the Capital Market Development Authority (CMDA) in 2008, has consistently introduced technological innovations to strengthen the Maldivian securities market. Initiatives like the Infinity self-service portal, the electronic AGM management system “Fahivote,” the Securities Registry Management System (SRMS), and the private market platform “Viyana” have laid the groundwork for today’s advancements.

The online trading system, developed entirely in-house, underwent a beta phase starting in June 2024 with a select group of users. Following rigorous regulatory checks, the CMDA granted its approval on 22 January 2025, paving the way for its official launch.

Empowering Investors

The Trade Connect feature is designed to enhance transparency and accessibility for investors. Through the platform, users can monitor real-time market information, price changes, and order book details, enabling them to make well-informed decisions. Furthermore, the system’s API integration provides brokers with the flexibility to expand their services and cater to a broader clientele.

The platform allows investors to submit trade requests at any time via their preferred broker or by registering with new brokers. Brokers verify each request as per regulatory guidelines before forwarding it to the Exchange, ensuring compliance and reliability.

The MSE’s commitment to innovation underscores its dedication to fostering growth in the Maldives securities market. The launch of this online trading system is a testament to the efforts of its staff, management, and stakeholders. As the Exchange continues to build on its sustainable approach, it aims to further develop and expand its services in the years ahead.