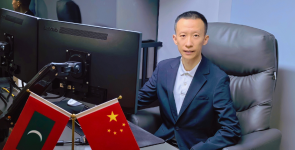

Mr Maniku joined Government services right after finishing school and has been serving the nation for the past 30 years. Having worked in the biggest government companies and having served as a diplomat, Mr Maniku is one of the defining key figures of the nation’s corporate sector. Mr. Maniku became the first CEO of the newly established Pension Office which administers the nation’s largest pension fund. Corporate Maldives sat down with Mr Maniku to talk about his vision in the fast growing and important pension industry of the country.

Tell us about your career and your involvement with MPAO?

I started my career in public finance at the ADB/IMF/WB unit established at the Ministry of Finance, which later became the MMA. In 1981, I went to Beirut, Lebanon to pursue higher studies and due to the war, returned back to Maldives and started serving the newly established MMA. After the war ended, I resumed my studies and after completion I came back to Maldives and started serving at the Ministry of Finance.

Later on, I was appointed as the Deputy Director of FPID, which later became MIFCO in 1991. Following, the corporatization, I was transferred to STO the parent company of MIFCO. In 1993, I was appointed as the Managing Director of STO and served the company as MD until 2008. During that year, I was appointed as the Maldives ambassador to USA, and briefly served as ambassador until the change of Government in November 2008.

I joined MPAO, in 2009 as its first CEO following the establishment of the Pension Office under the Pension Act. The purpose of MPAO was to administer the Maldives Retirement Pension Scheme (MRPS) and Old-age basic pension scheme. This changed the pension system in the Maldives completely.

First, MRPC is a DC scheme, where the pension depends on contributions and earnings on contributions. Whereas the pension system in existence when the law came in was a DB scheme, where the state guarantees a certain pension.

Secondly, the new scheme is universal and mandatory for all working Maldivians, it’s not only for the state sector which was the case in the pension system in existence.

Thirdly, the state guarantees a certain pension for all, irrespective of sector.

The new pension scheme was designed based on WB’s multi pillar concept. The system is to address two social objectives; the income smoothing objective and poverty alleviation. The idea of income smoothing is to have a system whereby people’s livelihoods are not greatly affected when they retire and that they get an income to support their lifestyles during the retirement. However, this is only possible for people with formal employment and contribution history. That’s not the only group of people in a society. There are people without formal employment and contributions so there should be a formal system whereby they are also protected from the poverty trap. The old-age basic pension scheme aims to address this issue.

I feel very fortunate and privileged to serve as CEO of this important national institution I and feel proud to be part of the team up until today.

What are the challenges faced by the company and for pension and pensioners as a whole?

The biggest challenge was to make sure that the implementation arrangements are finalized within the time frame set out by the law.

Actually, the time we had was very tight. Establishment of office, the board and the various regulations and policy documents that need to be completed by the deadline in accordance with the law was obviously a challenge. But, our board at that time did an excellent job. I am extremely grateful for their service and the passion they had.

Now then, we have established the pension system, the recordkeeping system is in place. The pension collection system is in place and the investment management area is also established. As you know, MRPS is a unitized fund. The idea is unique and the administrative setup we have in place is quite robust.

However, the challenge is finding investment opportunities. We have constant inflows of contributions in the tune of MVR 80 Million and it is continue to grow very fast. We need more investment choices, diversification opportunities. We need the fund to be utilized for national development, to support infrastructure, create assets and deploying fund for income generating economic activities.

We have limitations in the law as to what instruments we can invest in and it is for good reasons. The capital market need to develop and we need policy cooperation and coordination for an optimal outcome for the nation.

What are the biggest accomplishments of MPAO with regards to this sector?

The biggest accomplishment is implementation of the administrative arrangements as envisaged in the pension law on time.

As mentioned before, the pension system that we are administering today is completely different. It required new set of skills and competencies and new ways of thinking. We were very fortunate to have a very experienced group of consultants supported by the World Bank. We are also very fortunate to have talented locals working with us to ensure that the administrative arrangements are robust.

Our pension collection system is very unique, where the whole process is automated and user driven. Our system is live 24/7 and accessible from anywhere where there is internet. Employers can use the banking system to make monthly pension payment.

Then the reconciliation of pensions is also automatic, there is no manual reconciliation, which would have been very error prone and would have taken a long time to allocate funds to members. With an automatic reconciliation, pension contributions can be invested quickly without further delays.

We also have been able to provide decent returns to our members despite the challenges in the market. We have some degree of asset class diversification. We have two fund choices to our members; sharia and convention.

Most recently, we have started a program to use pension saving for home purchase. Under this program, we allow MRPS members can use their retirement saving to finance the down payment requirements of mortgage loans.

We also have a planned program to launch retirement annuity products; this program will enable lump sum withdrawals and address the issue of longevity risk.

We have made MPAO a household name through our stakeholder engagement programs; like the Finance Forum and various other public relations activities we conduct.

We also have invested heavily on our human resource development. We have a talented pool of locals who are competent and passionate about MPAO.

How has the current pension scheme made a difference in the community and a country as a whole?

We are in the business of ensuring adequate retirement income and safety nets for working Maldivians when they retire from work. We build asset pools which can be used for this purpose.

We have built the largest asset pool in the country, with retirement savings accounts for almost everyone working in the country and a very good compliance rate which I think are good indicators of the public’s acceptance of the pension system.

We have made the stakeholders aware of the potential of pension fund. We have created an interest in the capital market. We can bring in the much needed, medium to long term finance in the economy. During the last two years, we have seen an interest in the pension fund. We have had discussions with reputable private sector companies. We have started receiving financing proposals. We are very optimistic about the future.

What is the future of pensions and the MPAO?

When people retire, we want them to live reasonable lives by ensuring that they do not fall into the poverty trap.

In future, we will be able to introduce investment choices for the members. Depending on one’s age profile, choices can be made as to what financial assets to invest in. for example, if you are young, you can have most of savings in equity as returns on equity tend to do better in the long run. So we would like to introduce lifecycle funds in future.

At present the investment choices are based on default funds. Members to not have investment choices. This will change in future, with changes in capital market conditions and financial literacy.

We will continually improve our technology platform and improve the user experience of our system and will continuously monitor our investment policy and strategy and build a more robust pension pool which is diversified nationally as well as internationally. We will ensure that MPAO is attractive place to work for best and brightest local talent.

We have also planned to introduce, disability insurance schemes in future. We also would like to introduce different retirement products. We also would like to expand on our CSR and work with policy ministries to address needs of the elderly.