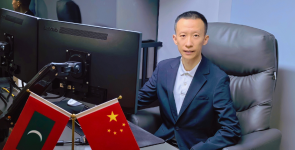

With more than 30 years of experience working in the banking sector of Sri Lanka and Bangladesh, Mr Dilan Rajapakse brings his unparalleled expertise in improving operational excellence and streamlining existing processes, systems and controls of banking systems to Commercial Bank of Maldives (CBM).

Corporate Maldives met with Mr Dilan to talk about his previous endeavors and his vision for CBM.

How did you get started?

I joined the Commercial Bank of Sri Lanka at the age of 19 as a junior entry-level person and worked my way up, taking on several roles in various branches and working in several departments throughout my tenure there. After that, I worked at the Bangladesh operation before getting the opportunity to work here in Maldives. When I first started working at the bank during my teenage years, I hadn’t even finished my A’ Levels. It was only while working at the bank that I completed my A’ Levels. Later on, I did my banking and some CIMA CBA level certificates, and I am still hoping to complete my full CIMA graduations. Back home in Sri Lanka at the Commercial Bank of Ceylon, it was normal for staff to join without many qualifications and then work their way up. That way they can take the professional exams while gaining experience at the same time, so they develop their careers and climb up the ladder.

How is working in Maldives different from the other places you have worked?

It is essentially the same. If you have ideas and try to understand the customers, you will be able to deliver the correct services in the best way possible. Same needs everywhere, but with a few cultural differences. The demands are the same, since it is all just basic human needs. Financially, in this specific market, there are products that we can develop more. It depends on the demands from the community.

In Maldives also you have the latest technological advances and the demands will be similar so we will soon have the same range of products and services that is found in neighboring countries. In terms of capital markets, I think there could be a lot of trade. We still have about ten companies listed and that will come up to a good level once those trading takes place.

Tell us about some of the challenges you have faced during your career.

Almost everything is a challenge, from handling human resources to reaching business targets set for every year. Understanding customer needs is very important so we innovate and create products to deliver. Here also we are studying, we want to understand more about the Maldivian needs and at the moment we have a full range of product that are delivered via digital means mostly, considering the country’s situation. At the moment we have all the generic products, and some high yielding savings product where you get interest on when you have higher balances. We also have different tenors of fixed deposits, and we cater to personal banking, SME and corporates and many others. To provide these facilities we have digital platforms, like e-passbook. We do not issue a printed passbook as some other banks do; our customers have it on their smartphone. We have a mobile app where they can do the mobile banking if they have the online banking facility. Through the app, you can do everything you want on your phone without having to come to the bank. Catering to the needs of each type of customer and every type of product is a huge challenge in their own way.

How about the challenges specific to Maldives?

Our biggest challenge was the dispersion of the islands in the Maldives, purely a geographical challenge. That is why we decided to utilize digital means to cater to the community. That is a challenge but we are very positive that we can look after the entire community.

What do you consider your biggest achievement?

Whatever the task that has been assigned to me, I consider it one of my biggest achievements. For instance, this bank and its challenges. We set up a new bank successfully as per the timelines given. If you look at the Bangladeshi operation I was at previously, it was a takeover for an existing bank – a well set up bank. While this is a completely new bank, and it also the first banking experience the CBC had. So I had to get involved in a personal level to overcome the challenges of a joint venture partnership and we did it successfully. We did it with the assistance from a lot of other companies and institutions here, of course, and the MMA provided huge support, making sure we understood the local regulations and everything. These are the achievements I consider the most important and ultimately I am very satisfied with what I have done.

What advice would you give to the younger generation looking to find success in the financial sector?

I would like to say that banking is a profession and that you practice and gain experience in it for a minimum of ten years before you consider yourself a banker. You have to relentlessly and passionately pursue it as a career. I don’t think it is all that important to gain the necessary qualifications before you approach banking as a career. What matters is experience. You can get the necessary qualifications later when you need it. If you’re determined to pursue a banking career, all you need is preliminary qualifications like A’ Level. That will do for a starting point. After that, there are many options like CIMA and ACCA, which are directly relevant to the banking industry. Once you do that, I think you can be a good banker.

What do you see for the future of this company and for yourself?

For the company, we actually want to reach most of the parts of Maldives as soon as possible. We want to partner with upcoming companies, to develop and make them grow as per the bank’s mission statement. We have corporate projects and goals set out for the near future and we are working towards achieving that. In the future, we are going to introduce international cards like MasterCard and Visa. We are also trying to provide payment gateways. These are some of our future goals and that will make things very easy for our customers. The present demand is for digital means, so that is the direction we have set out. For me personally, I want to be a successful person driving the bank towards its objectives.