Nationalism is often sold as protection. In practice, it frequently begins with classification, moves into suspicion, and ends with exclusion. In small economies, especially those that rely on mobility, services, and openness, that progression rarely stops at rhetoric. It reshapes policy.

Over the past weeks, the Maldives has entered that progression decisively.

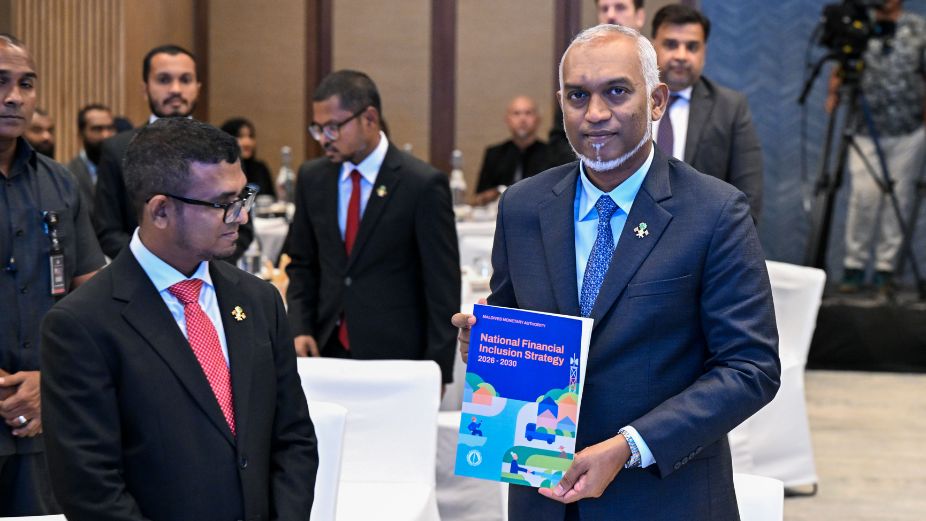

Foreign worker quotas are being phased out across a wide range of professions, including nurses, teachers, engineers, pilots, accountants, beauticians, and dive instructors, with timelines ranging from two to five years. At the same time, police and immigration authorities have begun a nationwide programme to stop and question expatriates found in public spaces between midnight and six in the morning, following a directive announced by President Dr Mohamed Muizzu on social media. On the first night of the programme, 23 expatriates were questioned. One was arrested for violating existing laws and handed over to Immigration.

The government describes these actions as regulation and enforcement. Taken together, they represent something more coherent and more troubling: the steady normalisation of a worldview in which expatriates are no longer treated primarily as workers within an economy, but as a social problem to be managed.

This shift matters because the Maldives is not an economy that can function on symbolism alone. Census-based data shows that roughly one in four people living in the country is a foreign national. Expatriate workers dominate employment in tourism and construction, the two sectors that generate income, foreign exchange, and infrastructure at scale. Healthcare, education, logistics, and technical services rely on smaller but indispensable pools of foreign professionals. These are not marginal roles that can be substituted casually. They are embedded in how the country operates.

Localisation is a legitimate policy goal. But localisation without capacity is not policy. It is theatre.

Nursing cannot be replaced on a political timetable. Teaching cannot be scaled without years of training, mentoring, and retention. Aviation and marine professions operate under international licensing regimes that do not bend to domestic sentiment. Even service roles such as beauticians or guest relations officers persist not because employers prefer foreigners, but because demand exists and supply does not meet it consistently.

The revised expatriate employment regulation illustrates the problem clearly. After initial backlash, baby sitters were quietly removed from the phase-out list, an implicit acknowledgement that some decisions were made without basic labour market logic. Yet nurses, teachers, and pilots remain on the clock. The state reserves the right to revise lists again, which suggests awareness that labour availability may not cooperate with ideology. What remains unaddressed is the disruption risk during the interim.

Alongside labour restrictions, enforcement has taken on a distinctly performative character. Police are not stopping people because they are committing offences. They are stopping them because they are expatriates, in public, at certain hours. Behaviour becomes secondary to identity. This is not neutral law enforcement. It is profiling, justified by vague appeals to social norms.

That distinction is important. Illegal employment, proxy ownership, labour exploitation, and undocumented migration are real problems. They deserve serious enforcement. But enforcement aimed at illegality looks very different from enforcement aimed at visibility. When the state instructs police to question people based on who they are rather than what they are doing, it crosses from regulation into suspicion.

This is how nationalism hardens.

Extreme nationalism in small states often presents itself as defence of sovereignty and social order. In practice, it reframes structural economic challenges as cultural ones. Labour shortages become moral failings. Regulatory gaps become character flaws. Foreign workers stop being inputs in a production system and start being treated as contaminants.

The Maldives is not unique in facing these pressures. Small island economies across the world rely on migrant labour to sustain tourism, healthcare, and infrastructure. Those that function best do not deny this reliance. They manage it. They regulate entry, enforce standards, protect workers, and require skills transfer, while accepting that openness is not weakness but necessity.

What makes the current Maldivian moment distinctive is the convergence of labour policy, policing, and rhetoric. Biometric data has now been collected from more than 191,000 expatriates, with deportation threatened for non-compliance. Illegal businesses are being shut down in large numbers. Quotas are being cancelled. Night-time questioning is being normalised. Each step is defended as reasonable. Together, they create an atmosphere in which foreigners are constantly reminded that their presence is provisional and suspect.

Opposition figures have begun to articulate the concern more bluntly. Meekail Naseem, an opposition MP, described the policy direction as xenophobic and warned that it signals an erosion of civil liberties that will not stop with migrants. That warning should not be dismissed as partisan exaggeration. History suggests that when states normalise selective policing and identity-based suspicion, the boundary of who counts as suspect rarely stays fixed.

There is also a quieter cost that nationalism rarely accounts for. Economies do not respond to mood. They respond to capacity. When staffing gaps widen, service quality declines. When professionals leave, systems strain. When investors perceive unpredictability in labour access, they hesitate. None of this announces itself immediately. It accumulates.

The irony is that the Maldives is attempting to assert control over a workforce precisely because it is indispensable. That is not strength. It is misdiagnosis.

A serious labour policy would separate illegality from identity, enforcement from spectacle, and localisation from deadline politics. It would acknowledge that expatriates are not a temporary inconvenience, but a structural component of the economy the country has chosen to build.

Nationalism promises order. What it often delivers, instead, is fragility.