The global oil market has entered a volatile phase following coordinated US-Israeli airstrikes on Iranian nuclear sites, with fears rising over Tehran’s potential retaliation. One of the most pressing concerns is the threat to the Strait of Hormuz, a narrow but vital waterway through which nearly a fifth of the world’s oil flows. Any disruption there could have far-reaching consequences, including for small oil-importing nations like the Maldives.

Oil prices climbed sharply on Monday, with Brent crude peaking over 4 percent before settling at around $79.12 per barrel, its highest since January. US West Texas Intermediate (WTI) also recorded gains, while analysts at major banks warned of possible spikes above $100 if the crisis worsens. In one scenario modelled by Goldman Sachs, even a partial blockage of the strait could push Brent to $110 per barrel depending on the scale and duration of disruption.

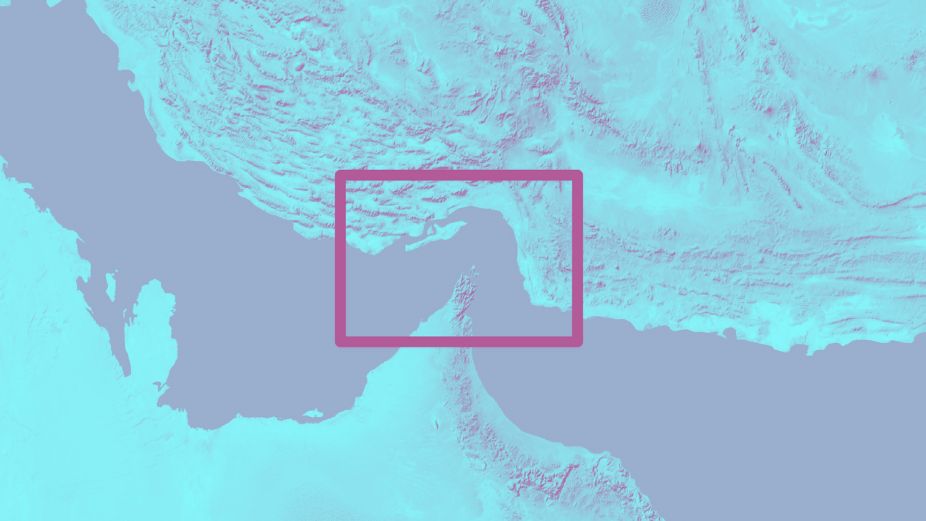

While Tehran has long threatened to close the Strait of Hormuz, the current moment appears particularly tense. Iran’s state-run Press TV reported that its parliament has approved a motion supporting such a closure. The strategic strait, which narrows to just 33 kilometres at its tightest point, is responsible not only for about 20 percent of global oil supplies but also for roughly a quarter of global liquefied natural gas (LNG) shipments, including supplies from Qatar.

For the Maldives, which relies entirely on imported fuel for energy and transport, any sustained rise in oil prices could have a pronounced impact. Higher global fuel prices would directly affect electricity generation costs and domestic transport, leading to increased living expenses for households and higher operating costs for businesses. In a country where imported fuel powers both the tourism industry and local infrastructure, these shifts carry the risk of inflation that disproportionately affects low-income families.

The government’s fuel subsidy bill, already under fiscal strain, would likely rise further if global prices continue to climb. This puts pressure on the state budget, especially in a context where the Maldives is already navigating high debt levels and limited fiscal space. Fuel prices set by State Trading Organization (STO) could also be adjusted upward if the company is unable to absorb the shock through existing hedging arrangements or reserves.

Tourism, the backbone of the country’s economy, may also feel the pinch. Although demand for luxury travel has shown resilience, resorts are heavily reliant on fuel for generators and desalination systems. If costs rise, these will likely be passed on to consumers in the form of higher prices which could affect competitiveness in a tightly contested regional market.

At a macroeconomic level, a sustained oil shock would likely worsen the Maldives’ trade imbalance as the cost of imports rises. In the longer term, this would put additional pressure on the country’s foreign reserves, which are already closely monitored due to vulnerabilities in the balance of payments.

Globally, markets are bracing for more volatility. Asian stock markets slipped on Monday, while European futures were also down. Currency movements reflected a mild flight to safety, with the dollar strengthening modestly against the yen and the euro. However, there was no immediate rush into US Treasuries, suggesting that investors are still gauging the likelihood of a broader conflict.

While some analysts hope that Iran may step back from its threats, citing potential self-harm from closing a route critical to its own exports, others remain cautious. Past regime changes in the region have historically led to price shocks, and any escalation could draw in further actors.

For now, the Maldives will need to monitor developments closely. With no control over global fuel markets and limited alternatives to fossil fuels, any geopolitical disruption in the Middle East translates into real economic consequences at home.