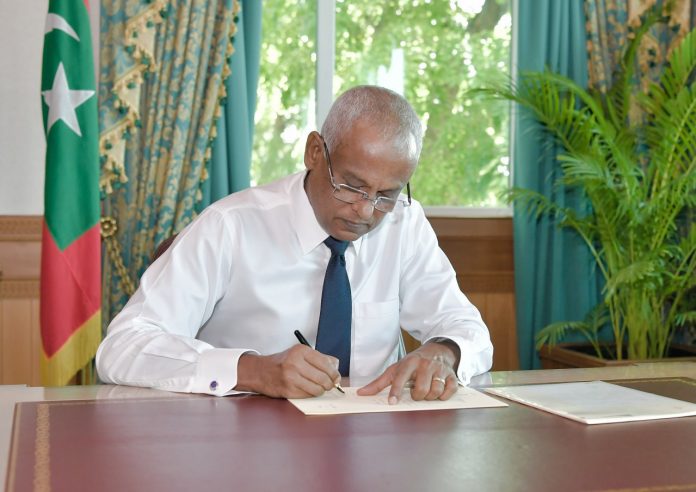

President Ibrahim Mohamed Solih has this afternoon signed the Income Tax Bill into law. Parliament passed the bill on 4th December 2019, at the 75th sitting of its third session.

As per the Bill, Income tax is levied on personal income and profit earned from businesses covering income received from entities in the Maldives by local and foreign individuals and companies. Income tax would be imposed on salary and wages; business profit; revenue from leasing current assets and non-current assets; dividend; interest; annuity; pension; retirement benefits; salary of beneficiaries; technical service fees; commissions; royalties; capital gains from disposal of current assets and non-current assets, shares and other business investments; and, any other income received from whichever source derived.

Annual personal income tax payables for individuals are categorised under five brackets;

- Below MVR720,000 – 0%

- MVR720,000-MVR1,200,000 – 5.5%

- MVR1,200,000-MVR1,800,000 – 8%

- MVR1,800,000-MVR2,400,000 – 12%

- Above MVR2,400,000 – 15%

Employee Withholding Tax would be liable under the following five brackets;

- Below MVR60,000 – 0%

- MVR60,000-MVR100,000 – 5.5%

- MVR100,000-MVR150,000 – 8%

- MVR150,000-MVR200,000 – 12%

- Above MVR200,000 – 15%

Business Profit Tax and Bank Profit Tax regimes would be integrated into the new law, while the Land Sales Tax, Tax levied from the revenue of Petroleum Companies and the Remittance Tax would be abolished once the new law comes into effect. It levies taxes on residents for income earned within or outside the Maldives; non-residents for income generated in the Maldives; and from temporary residents for income sourced in the Maldives.

The tax rates would remain unchanged for banks at 25% on profits, while taxes of 15% on profits that exceed MVR500,000 would be levied on corporations, partnerships and other business entities. The law also outlines exemptions on income tax. Upon ratification, the law has been now published in the Government Gazette and will come into effect from 1st January 2020.